Home Files

Home Files by Carlisle Homes is your ultimate guide to home-building and design. Whether you’re a first-time buyer, planning a knockdown-rebuild, or looking to upgrade, Home Files offers expert insights, practical tips and inspiration to guide you through every step of your journey.

Explore Home Files and discover why Life’s Better when you build with Carlisle Homes.

Dream

Why Wait? Move In Now, Style It, Love It.

Endless house hunting, underwhelming inspections, compromise after compromise—does your home search sound familiar?

Read More

Winter Warmers: Cosy Ways to Entertain at Home This Season

With the days shorter, nights colder, and the couch calling your name more often than not, it’s tempting to go into full hibernation mode during winter.

Read More

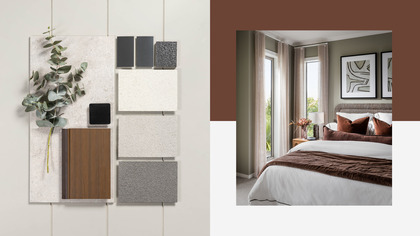

What’s Hot Right Now: New Neutrals, Bold Colour, and Statement Stone

Interior design, like fashion, evolves with time. But this year’s standout trends feel less like passing fads and more like enduring style shifts.

Read More

What’s Happening in Werribee: Local Events and a Thriving Lifestyle

As one of Melbourne’s youngest and fastest-growing regions, the western suburbs are alive with possibility.

Read MoreDesign

The Art of Lighting: How to Create a Beautifully Lit Home

When it comes to designing your dream home, lighting should never be an afterthought.

Read More

The Hottest Wall Trends for 2025 from Muted Tones to Statement Finishes

Your walls are more than just a backdrop—they’re one of the easiest ways to define the mood and personality of your home.

Read more

Two Beautiful New Display Homes Are Opening at Riverfield Estate

Big news for families ready to make their move.

Read More

Meet the Chelsea Grand 37: Luxury living has never been more affordable!

Stunning features, spacious living and ample room to grow – the Chelsea Grand has it all!

Read MoreHow to get the Luxe Noir Look

Learn from our expert Interior Designer Jess Hodges on how you can implement this scheme into your home.

Build

Knockdown Rebuild vs Renovation: 5 Reasons to Start Fresh

There comes a point when no amount of paint or patch-up jobs can disguise an old home’s flaws.

Read more

To Build or to Buy (Brand-New)? Let’s Break It Down

Two ways to find your perfect home—both new, both yours, it’s just a matter of approach.

Read more

What's Inside that Counts: Spacious and Affordable Home Designs for Small Blocks

Gone are the days where building on a small block meant compromising on space, functionality and stunning design.

Read more

Dream Homes Tailored for 14-Metre Blocks

Find your dream home tailored for 14-metre blocks with Carlisle Homes. Explore smart, stylish designs perfect for your lifestyle. Start building now!

Read moreFinance

The Finance Essentials: Understanding How Much You Can Borrow

When you’re planning to buy or build a home, one of the biggest questions is: how much can I actually borrow?

Read More

How Much Deposit Do You Really Need to Buy a Home?

Wondering how much deposit you really need to buy a home? Carlisle Homes breaks it down simply. Get informed and take the first step towards your new home!

Read More

From HELP Debt to Home Keys: The Policy Change Opening Doors

There’s good news for young Australians with HELP debt (formerly HECS) hoping to enter the property market.

Read More

How a Rate Cut Could Boost Your Borrowing Power in 2025

With potential rate cuts on the horizon and the first home buyer price cap possibly rising to $950,000, 2025 could be the year you finally buy.

Read MoreNews

Pull On Your Brightest Socks – It’s Time for Sock Out Sunday!

Looking for something meaningful to do with the whole family this May?

Read More

Start Your Homeownership Journey at Carlisle’s First Home Buyer Festival!

Thinking about buying your first home?

Read More

Celebrate Holi at Home: Refreshing Thandai Recipe & Colourful Festivities

Holi, the festival of colours, is one of the most vibrant celebrations in the Hindu calendar.

Read More

Small Deposit? No Problem! Getting Your First Home Is Easier Than You Think

Owning your first home might seem like a distant goal, especially with rising house prices and the long-held belief that you need a hefty deposit to secure a mortgage.

Read MoreVideo

How Much Deposit Do You Really Need to Buy a Home?

Watch Now: Discover how much deposit you need to buy your dream home!

View Video

Everything You Need to Know About Construction Loans

Watch now: Discover the smart way to finance building your dream home!

View Video

Why Melbourne’s Northern Suburbs Are Booming for Homebuyers

Watch now: Discover Redstone Estate, a community designed for effortless living with everything you need right at your doorstep.

View Video

The Finance Essentials: Understanding How Much You Can Borrow

Watch now: Understand the key factors that influence your borrowing capacity.

View VideoPodcast

Season 2 - Episode 2: Affordable Abode: Budgets and Finances

Experts share insights into managing home finances and budgets. Join Janine Armstrong and Mark Polatkesen for practical advice to make homeownership affordable.

Listen Now

Season 2 - Episode 1: First-home buyers: Choosing to build a new home

Hear insights from experts on building your first home with Carlisle and Frasers Property. Gain valuable tips for first-time homebuyers in this podcast.

Listen Now

Season 2 - Episode 3: Dream design, Perfect space: Maximising your block

First-time homebuyers can stretch their budget with these tips to maximize space and create a dream home on a tight budget. Learn from the experts.

Listen Now

Season 2 - Teaser: First Home Building Made Easy

Join host Caitlin Judd for an inside look at each phase of the home building journey, with insights from industry experts on how to achieve homeownership.

Listen Now