What is an emergency fund and how much do you need?

by Carlisle Homes

In times of financial uncertainty, having an emergency fund can provide peace of mind and help you weather unexpected expenses or income disruptions. But how much money should you set aside, and where should you keep it?

An emergency fund is a savings account that you can tap into in the event of an unexpected expense or loss of income. It’s designed to cover your basic expenses, such as housing, food, and bills, for a certain period. The goal of an emergency fund is to give you a financial cushion so that you don’t have to rely on credit cards or loans to cover unexpected expenses.

An emergency fund will give you a financial cushion so that you and your family don’t have to rely on credit cards or loans to cover unexpected expenses.

How much should you save? A good rule of thumb is to save enough to cover three to six months of living expenses. This can vary depending on your personal circumstances. For example, if you have a stable job and no dependents, you may get away with saving less than someone with a variable income or a family to support. A good starting point is to look at the Henderson Poverty Line, which provides a benchmark for the disposable income Australians need to support themselves. You can also review your actual expenses over a three-month period to get a sense of how much you need to cover your basic needs.

Where should you keep your emergency fund? There are several options for storing your emergency fund. One option is to keep it in a high-interest savings account. This can help your money grow over time and earn interest, but you’ll want to look for an account that pays extra interest if you don’t make withdrawals. Another option is to store your emergency fund in a mortgage offset account or redraw facility. This can help reduce the interest you pay on your mortgage and speed up your mortgage repayments. Ultimately, your best option will depend on your circumstances and financial goals.

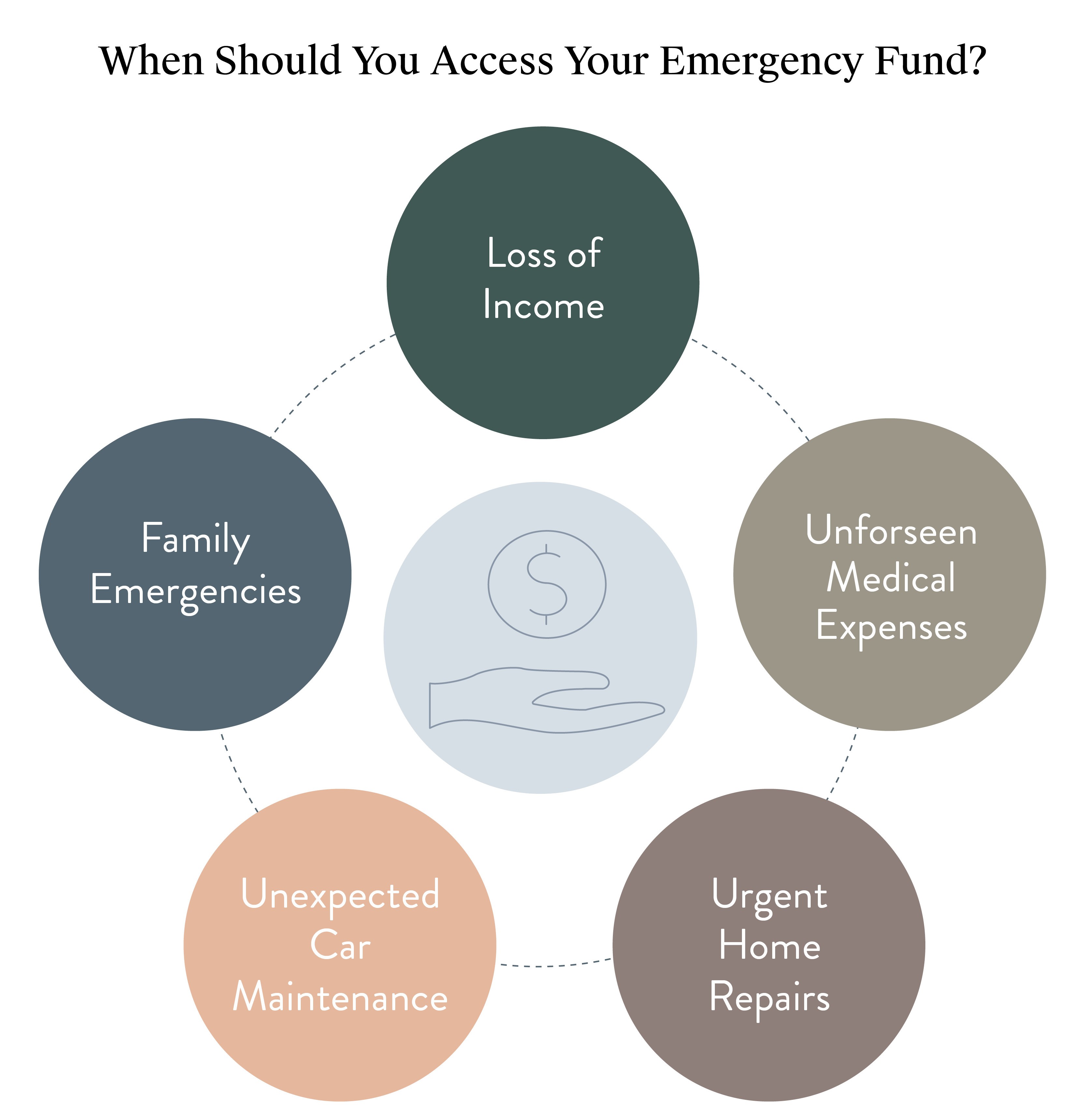

When should you access your emergency fund? Having clear guidelines for when to access your emergency fund is important. Some common examples of when you might dip into your emergency fund include:

- Loss of income due to job loss or illness

- Unexpected medical expenses

- Urgent repairs to your car or home

- Family emergencies or crises

It’s important to remember that emergency funds are designed to cover basic needs, such as food and bills, and not discretionary expenses like entertainment or travel. If you need to dip into your emergency fund, try replenishing it as soon as possible.

Having an emergency fund can provide peace of mind and help you navigate unexpected expenses or income disruptions. By determining how much to save, where to keep your money, and when to access it, you can create a safety net for yourself and your family.

For extra help in planning for the unexpected and securing your dream home, get in touch with our in-house finance specialists.