Small Deposit? No Problem! Getting Your First Home Is Easier Than You Think

Owning your first home might seem like a distant goal, especially with rising house prices and the long-held belief that you need a hefty deposit to secure a mortgage. However, with government schemes, financing options, and house-and-land packages tailored for first-home buyers, getting into the market may be easier than you think.

To help navigate the options, Mark Polatkesen, Managing Director of Mortgage Domayne, shares key insights into how buyers can purchase their first home with a smaller deposit—and why waiting to save for the traditional 20% may not always be the best approach.

A 20% deposit isn’t always needed—first-home buyers are using smarter strategies to secure their future.

How much do you really need for a deposit?

Many buyers assume they need a minimum 20% deposit to purchase a home to avoid adding Lenders Mortgage Insurance (LMI) costs to the loan. But with rising property prices, saving for that minimum can feel impossible.

“Unfortunately, most first-home buyers just cannot save at the same rate as house price increases,” says Polatkesen. “In that case, eligible first-home buyers could consider accessing the First Home Guarantee (FHBG) scheme, letting them secure a home with as little as a 5% deposit, and negating LMI costs as the government is essentially ‘guaranteeing’ that additional deposit requirement.”

“This would reduce the deposit required for, say, a $600,000 property, from $120,000 down to just $30,000, or if you were considering an $800,000 house-and-land package, this would allow you to move forward with just a $40,000 deposit,” describes Polatkesen.

Saving for a deposit is just one part of the equation—finding the right home within your budget is equally important. Carlisle Homes offers a range of fixed-price house-and-land packages designed for first-home buyers, making it easier to take that next step with certainty about what their deposit can get.

In the $600,000 range, you might consider the Ashbourne 19 at Lyra Estate in Beveridge from $622,000*, while those looking between $700,000 and $800,000 could explore the Inspire Collection’s Walton Grand Pantry 29 at Mandalay Estate in Beveridge for $773,100*.

With the right financing options and government incentives, first-home buyers are getting into the market sooner.

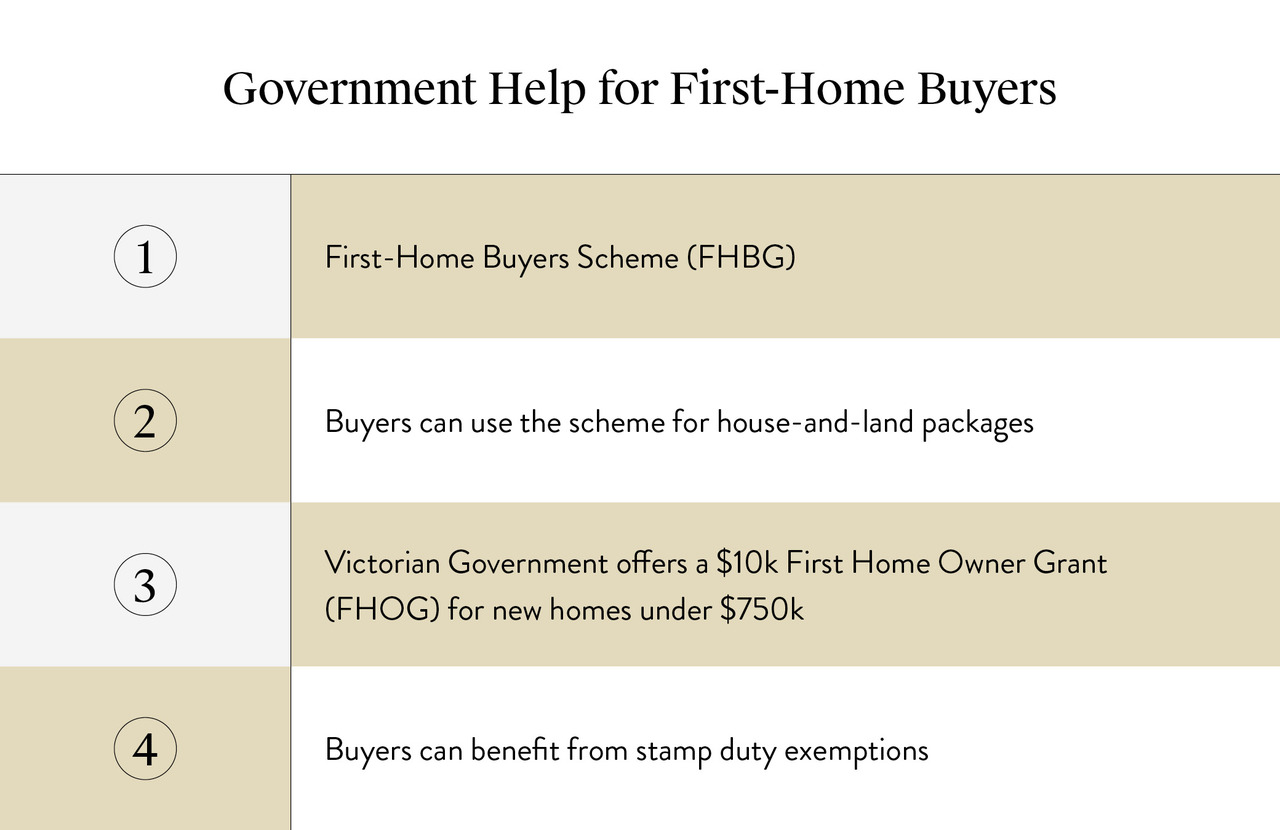

Government schemes that help first-home buyers

The FHBG is one of the most effective ways for eligible buyers to enter the market sooner, but key criteria must be met to take advantage of it. Applicants must be first-home buyers purchasing an owner-occupied property and meet income thresholds. Notably, the scheme also has property price caps depending on location, which buyers should be aware of when searching for their new home.

For those buying in Melbourne and Geelong, the price cap is $800,000, meaning buyers can use the scheme for house-and-land packages up to this amount. However, for the rest of regional Victoria, the price cap is lower at $650,000.

“Using the FHBG can undoubtedly speed up your deposit saving and home buying process,” says Polatkesen. “But not every lender participates in this scheme, and making sure you tick the right boxes and fit the eligibility criteria is crucial, so speaking to a broker can help streamline this.”

Considering the price cap, Carlisle’s house-and-land packages can make an excellent option for first-home buyers. For example, flying well under the threshold, the value-packed EasyLiving Series’ Edgewood 23 at Lillifield Estate in Warragul from $602,600* is a desirable choice, while those wanting to maximise their lifestyle within the cap could still explore the Affinity Collection’s Sebel 33 at Drouin Fields Estate in Drouin from $779,500*.

State government incentives for first-home buyers

In addition to federal schemes, the Victorian Government offers a $10,000 First Home Owner Grant (FHOG) for new homes under $750,000. This can significantly reduce upfront costs and help buyers enter the market more easily.

“The key point here is that the $750,000 cap applies only to the construction value and does not include the land, making it an excellent option for house-and-land packages,” explains Polatkesen. “You can also use this grant as part of your deposit and to cover associated purchasing costs, so having a broker guide you through this process is invaluable.”

Buyers can also benefit from stamp duty exemptions. First-home buyers who purchase land under $600,000 for owner-occupier purposes can avoid paying stamp duty altogether, further reducing costs. These savings could be just what you need if you’re looking to secure land first and then seek out a Carlisle Home design to build on your block later down the track.

Use Carlisle Homes’ finance calculators to help you plan your home-buying journey.

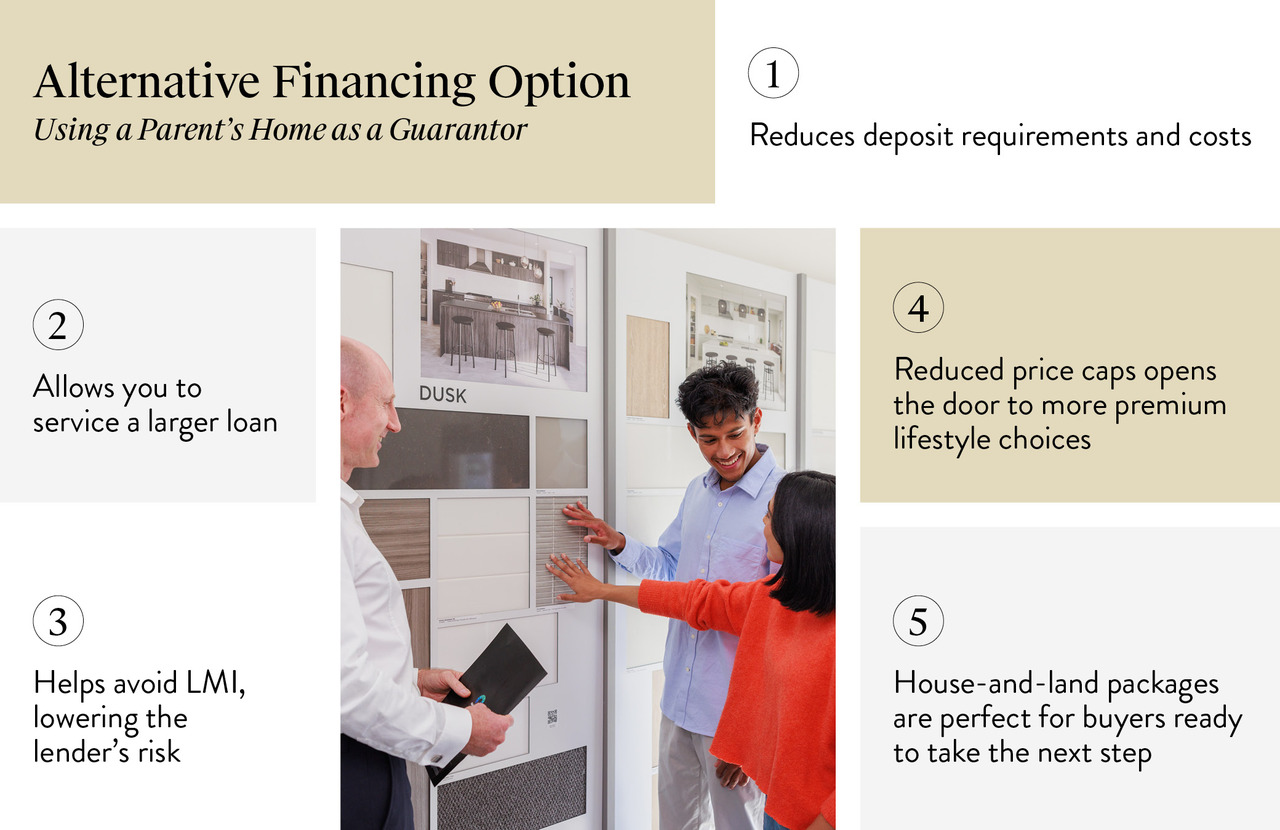

Alternative financing options

If you don’t qualify for these grants and schemes or are looking to purchase an investment property, there are other ways to enter the market to reduce your deposit amount or purchase costs.

“Using a parent’s home as a guarantor is a common pathway to reduce deposit requirements and costs,” Polatkesen explains. “This can help avoid LMI, as part of the loan is secured against their property, lowering the lender’s risk.”

If this is a feasible pathway and you can comfortably service a larger loan, then price caps also aren’t a concern—opening the door to more premium lifestyle choices. This means you can focus on finding a home that offers extra space, upgraded finishes, and a location that genuinely suits your long-term vision.

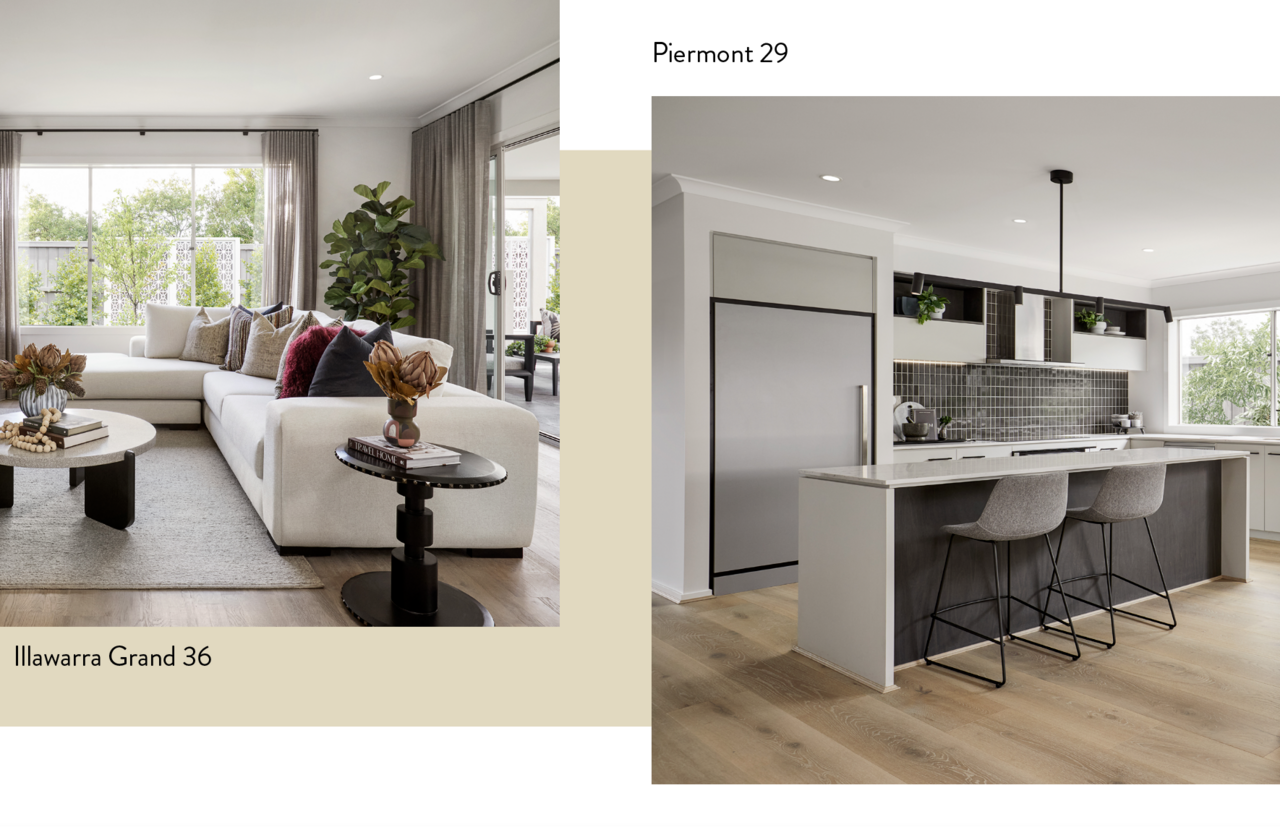

For buyers ready to take that step, house-and-land packages such as the Affinity Collection’s Illawarra Grand 36 at Banksia Estate in Armstrong Creek from $857,000* or the Inspire Collection’s Piermont 29 at Sunbury in Redstone from $811,500* may have strong appeal.

House-and-land packages are making homeownership simple—helping buyers sort out finance and find their dream home in one go.

Using Carlisle Homes’ finance calculators

Understanding your budget is one of the most crucial steps in the home-buying process, and Carlisle Homes conveniently offers a range of finance calculators to help first-home buyers assess deposit requirements, purchase costs, and estimated repayments.

“They are a great reference to get some initial information and guide you on parameters,” Polatkesen says. “However, speaking to a broker is always a good idea, as every buyer’s situation is unique, and we can tailor a solution based on your goals.”

What first-home buyers should keep in mind?

Leaping into homeownership can be daunting, but many misconceptions hold buyers back from making their move.

“Many first-home buyers believe they need that big deposit, but debunking that myth is the first step to getting into your first home sooner,” says Polatkesen.

“Another common misconception is that borrowing capacity is the same across all lenders, but it can vary,” Polatkesen explains. “Some lenders may assess your income and expenses differently, meaning you could be approved for more—or less—depending on where you apply.”

Polatkesen also advises first-home buyers to be mindful of how much they borrow. “Just because you’re approved for a certain amount doesn’t mean you have to borrow the maximum. It’s important to choose a loan that fits comfortably within your budget, both now and in the future.”

Finally, he encourages buyers to explore all their options. “Shop around for home loans—your bank may not be offering the best deal. We work with over 60 lenders, and they all vary with products and rates. Exploring your options and seeking expert advice can help you make an informed decision.”

Ready to take the first step towards homeownership? Contact our team today to explore financing options, government grants, and house-and-land packages designed for first-home buyers.

Disclaimer:

*Price does not include any stamp duty, government, legal, or bank charges. Hebel discount taken off full retail price. Carlisle reserves the right to withdraw or change price, inclusions or promotion without notice.