What is Equity? And How Can it Help You?

Use your new home to maximise your future. Here’s how.

There are many benefits to owning your own house. You can paint the walls whatever colour you like, hang pictures without restraint and never worry about a rental inspection again. But great as those perks are, none of them compare to your new ability to build equity and realise your dreams.

What is equity?

Equity is the difference between your home’s value and what you owe on it.

When you first buy a home, your equity will be limited.

Let’s say you’ve bought a $600,000 house and land package, using $100,000 from your savings as a deposit and taking out a $500,000 loan. At the time of settlement, your property is usually valued at the amount you paid, which is $600,000. Your equity is $100,000: $600,000 minus the $500,000 you owe.

Fast forward five years. By sticking to a budget and paying extra towards the mortgage, you’ve managed to pay another $100,000 off the principal of the loan. You now owe $400,000. In the same time period, your property has increased in value. Using the average growth rate of 6.8% per year over the past 25 years, we can assume your property will be worth around $850,000.

Your equity is now $450,000: $850,000-$400,000.

The longer you hold a property, the more equity you’ll build. But there are ways to access that money in the meantime. You can:

Sell and upgrade

There’s a reason that so much financial advice is aimed at first home buyers. Once you’re past that hurdle, it’s much easier to realise your next property goal. When you sell your property, you’ll realise profits from the increase in value. That takes the pressure off your budget and gives you a head start in affording the next home.

If you’ve just bought your first home then the hardest part is over, watch your property’s equity grow with you and look towards your next property goal.

Borrow for a second home

Perhaps you’re dreaming of a holiday home? Or you want to upsize to the dream family home but keep your current place to rent out? Thanks to the power of equity, you don’t need to save for a new deposit. If you have enough equity, the bank will accept that as security for the new place.

You can approach this in a couple of ways. Let’s go back to our original example. Five years after buying, you have $450,000 in equity and owe $400,000 to the bank. You want to buy a bigger home that’s priced at $1.2M and keep the existing one.

The bank will look at two things. One is the loan-to-value ratio across both properties. That is, is the deposit or equity at least 20% of the total value? In this case, you’d be holding a $850,000 property and a $1.2M property: total $2.05M. The equity in your first place is $450,000, which puts you over the 20% mark that the banks will look for. To find out more about home loan eligibility see here.

Of course, you still need to prove that you’ll be able to meet the mortgage repayments on both properties, so it’s not a done deal quite yet. However, removing the need for a new deposit can be a significant bonus. You’ll also be receiving rental income from the property you’re going to rent out, which is counted towards your income for the purposes of serviceability.

Consider your options as your equity grows! Strike a better deal refinancing your loan or get rid of LMI once your equity reaches 20%.

Refinance and create your dream home

There are two main reasons you might want to refinance. The first is to get a better deal on your mortgage. The second is to borrow against your equity for an extension or renovation.

A better deal

A better deal on your mortgage might be as simple as getting rid of lenders’ mortgage insurance (LMI) once your equity reaches 20%. If you bought your home with a small deposit, you’re probably paying LMI - and you may have accepted a loan rate that wasn’t as low as you may have liked. Once your equity has built up, you become a lower risk borrower and may be able to access better rates.

Depending on your age and circumstances, you may also be able to ‘restart the clock’ with a new 30-year loan. This effectively spreads your remaining payments out over a longer period, lowering your monthly commitment.

Some loan products are only available to borrowers who want to borrow 60% or less of their home’s value. These are typically offered at low-interest rates, so if you qualify for one of these, they’re worth a look.

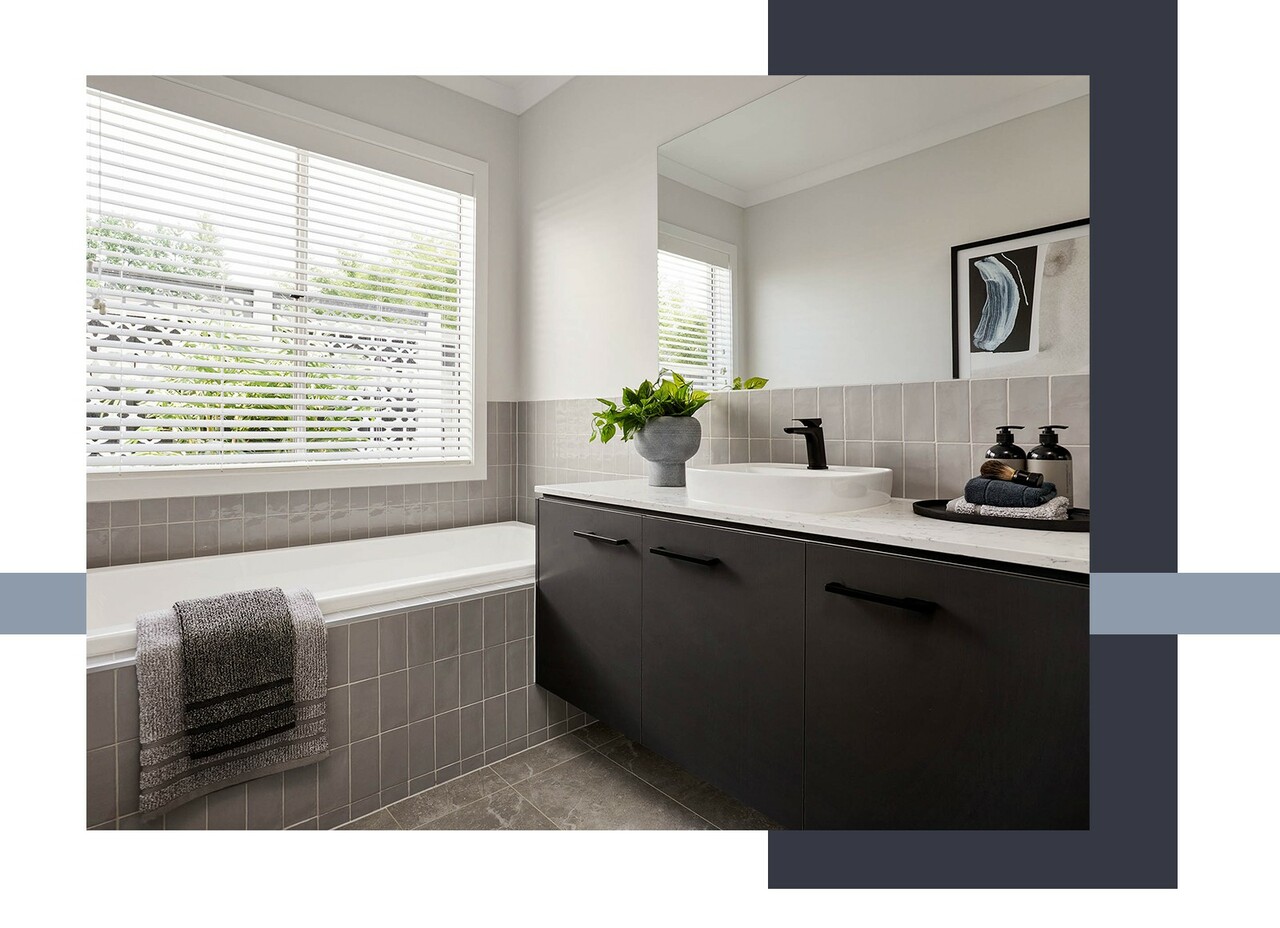

Dreaming up a new bathroom? Consider using your equity to fund your renovation. Featured here: Piermont, Redstone Estate, Sunbury.

Renovate or extend

If you’re planning to sell your property, you may want to consider a renovation first. An updated kitchen or bathroom, or even a rear extension, can add substantially to your selling price. This then becomes a bigger stepping stone to your dream home.

You can use equity to fund your renovation. A mortgage broker can help you determine how much you may be able to borrow.

You may choose to stay with your current lender or move to a new one. If you have a fixed loan, there will be a break fee to leave before the fixed term is up. Chat to your mortgage broker about the best option.

No matter why you’re refinancing, certain rules still apply. You’ll need to provide the bank with documents including payslips and bank statements. Expect a valuation of your property to be part of the process.

To explore the possibilities of your equity, get in touch with our in-house construction finance specialists. Not yet a homeowner? Get in touch with us on 1300 328 045 enquire about our house and land packages so you can start building equity faster.