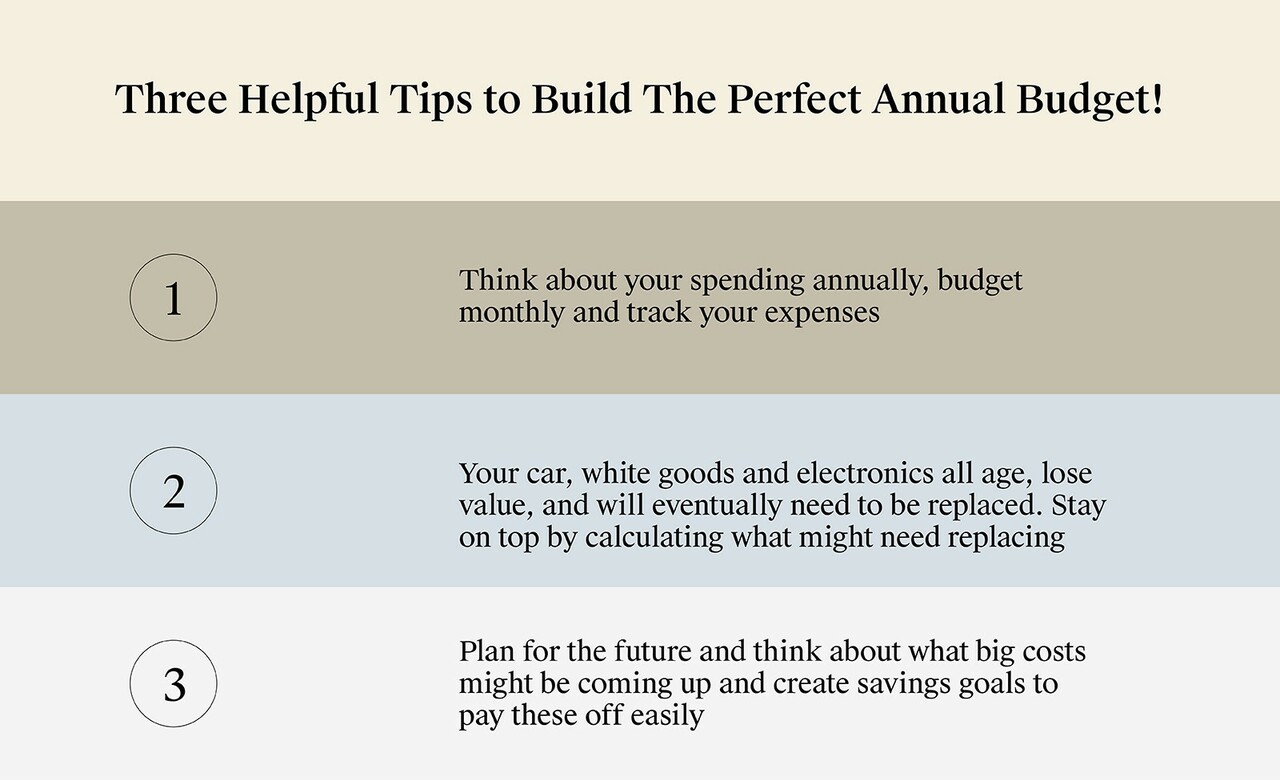

Three Tips to Plan The Perfect Annual Budget

For most, budgeting can be tricky and tedious, so here’s three helpful tips to build the perfect annual budget!

We’ve all been there. You’ve put together a budget, stuck to sensible spending habits and yet something always seems to come up. Maybe the car needs new tyres, or the school fees are due. The power bills soar in winter, and summer comes with Christmas costs.

If you find yourself thinking ‘next month will be better’ once too often, you may need to rethink the budget altogether.

Consider budgeting regularly, that way you can track expenses and get an accurate picture of what you actually spend!

1. Think annually, budget monthly

Most budget apps and templates assume that you’re budgeting monthly, fortnightly or even weekly depending on how often you get paid.

The truth is, many of our essential expenses happen less often than that. And the less frequent the expense, the more likely it is that you’ll overlook it when you’re working out your outgoings.

Take Christmas, for example. Have you ever added up how much you actually spend? There’s the presents, the extra food and drink, travel expenses if you visit relatives or bigger utility bills if you’re the host. Perhaps you’ll need a new outfit or two for those end-of-year events or an Uber home. Add all of it up, even the little things like wrapping paper or stocking gifts, and you may get a shock at the total.

It’s for this reason that it’s so important to approach your budget annually. Christmas and birthdays are big spending occasions, but if you know their real cost you can spread it out over all 12 months. Likewise, the annual car service can be a nasty shock if you have to find the money in a single month - but if you’ve been putting aside a little each pay, you have it covered.

Bottom line? If you’re only looking at the last month’s spending, your budget won’t be accurate. You’ll need at least 12 months' worth of transaction records to give you a clear picture of what you spend.

Depreciating assets can become a money pit, we recommend factoring that into your annual budget for no nasty surprises.

If it sounds tedious to translate a year’s worth of spending into a budget, don’t worry. Most banks already categorise your transactions to produce spending reports. These might not be 100% correct, but they’ll give you the oversight you need for this task. Check what your banking app offers in this regard - you might be surprised.

An alternative approach is to develop a budget based on your best guess but build in a buffer of 10%. Send that money to a ‘bucket’ (either a separate savings account or just allocate it to a line in your budget) that is untouchable. Hopefully, it’ll be enough to cover those occasional big expenses. If not, increase the buffer to 15% or 20%.

As you get into regular budgeting, you’ll be able to track expenses going forward and get a more accurate picture of what you spend.

While we’ve suggested a monthly budget, there’s no reason you can’t budget fortnightly or even weekly if that makes more sense for you. If you’re paying rent or mortgage costs fortnightly and getting paid on the same schedule, that might be your best approach.

2. Plan ahead for obsolescence

It’s not just the annual or quarterly bills that can take you by surprise. Occasional expenses pop up more often than you may realise. These, too, can be planned for.

Your car, white goods and electronics are all depreciating assets. They age, lose value, and will eventually need to be replaced. If you’re building a new house with a house and land package, be especially careful to take this into account, because your appliances will all be brand new when you move in. Many whitewoods and appliances have similar lifespans - that means that in 7 or 10 years, you might find you have to buy several replacements in one year. Ouch!

Think of your regular expenses! Be sure your annual budget includes future holidays, kid's birthdays and school fees.

Think about how often you generally replace your consumer electronics, too, such as mobile phones and other devices. Most of us don’t wait until our devices have stopped working altogether, preferring to upgrade occasionally. You know your own habits best: do you want the latest phone every year, or are you happy with a superseded model as long as it works? Either way, make sure you’ve calculated the real cost per year and folded it into your budget.

3. Plan for the future

This one’s a little trickier, but you don’t have to have your whole life planned out. When you’re planning a budget, look ahead to the next few years and think about whether there are any big life changes coming up. Perhaps you’re planning a wedding or hoping for children. If your children are heading off to Big School soon, will there be private school fees to find? Even state schools come with uniforms and other costs, which you can find out ahead of time.

That milestone holiday in a couple of years, too, should be planned for ahead of time. What do you need to save monthly to meet that goal? By thinking of your savings goals as part of your regular expenses, you’ll be more likely to meet them. After all, life is about enjoyment as well as paying the bills!