Save big on your dream home with 2025 rate cuts now

The start of a new year is a natural time to take stock of financial goals, and with interest rates at the forefront of many economic conversations, it’s more important than ever to evaluate where you and your family stand.

Whether you’re looking to buy your first home or considering a new-build upgrade, now is the perfect time to conduct a financial health check and understand the dynamic finance landscape of 2025—with a federal election pending, interest rate cuts forecasted, and your homebuilding dreams on the cards, you can never be more prepared.

With insights from Mark Polatkesen, Director and Senior Mortgage Broker at Mortgage Domayne, this guide explores key factors shaping the year ahead, including interest rate trends, and how buyers can position themselves for success.

Lower interest rates could make 2025 the best time to invest in a house and land package.

Start the year with a financial audit

The holiday season often brings extra spending, and over the course of a year, small expenses—such as subscriptions or memberships—can accumulate significantly, impacting your amount of savings. Conducting a personal audit can reveal unnecessary costs that could be redirected towards savings and get you on the fast track to a healthy home deposit.

“It’s a good idea to start the year with a review of your bank statements to see what isn’t necessary and eliminate unneeded costs,” says Polatkesen. “Reducing or eliminating these can be added to savings or used to satisfy repayments on an existing loan.”

Interest rate cuts on the horizon

With inflation trending downward and approaching the Reserve Bank of Australia’s (RBA) target range, market analysts anticipate at least one interest rate cut in 2025. The first RBA meeting of the year, scheduled for February 18, is expected to clarify potential rate reductions, which would present opportunities for borrowers.

“All four major banks are predicting a rate cut in this meeting,” Polatkesen says. “Rate cuts typically boost buyer confidence and activity, making homeownership more affordable in terms of repayments, but they can also drive up property prices due to increased competition—another reason to be prepared to act.”

Experts predict interest rate cuts will drive property demand, so being prepared is key.

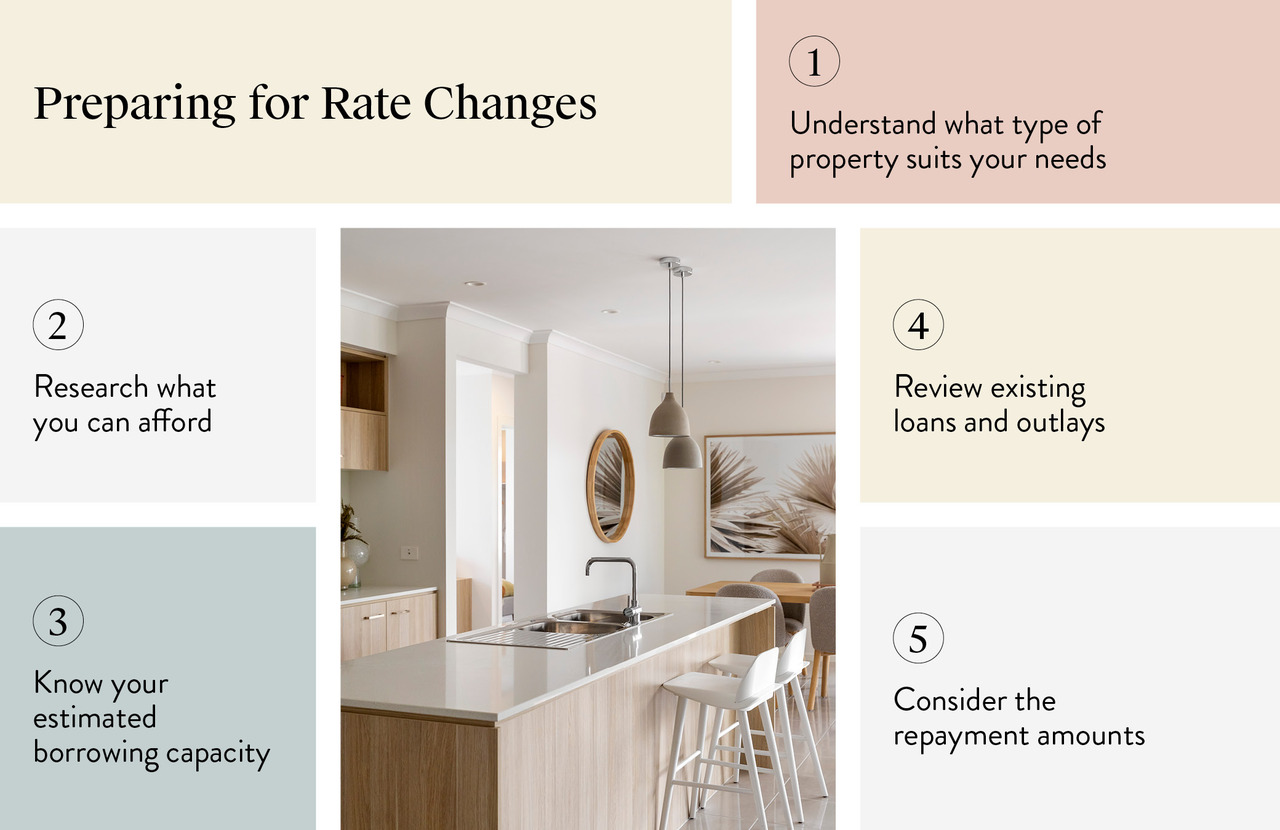

Preparing for rate changes

If you’re planning to buy a home in 2025, preparation starts with understanding what kind of property suits your needs and researching what you can afford. Knowing your estimated borrowing capacity and deposit amount will help determine which home designs are within reach. With potential rate cuts, this groundwork ensures you’re ready to act when the time arises.

“If rate cuts eventuate at any point this year, borrowers should take a proactive approach by reviewing their existing loans and outlays,” suggests Polatkesen. “Interest rates will vary between lenders, and some lenders may not pass on the full rate cut, which could mean your current rate is no longer competitive.”

“And when it comes to estimating your home buying situation, rather than focusing solely on the purchase price, consider the repayment amount,” explains Polatkesen. “These will be your long-term obligations, and allowing for fluctuations in repayment amounts is essential—whether rates go up or down.”

Now is the perfect time to buy, with interest rate cuts making homeownership more affordable.

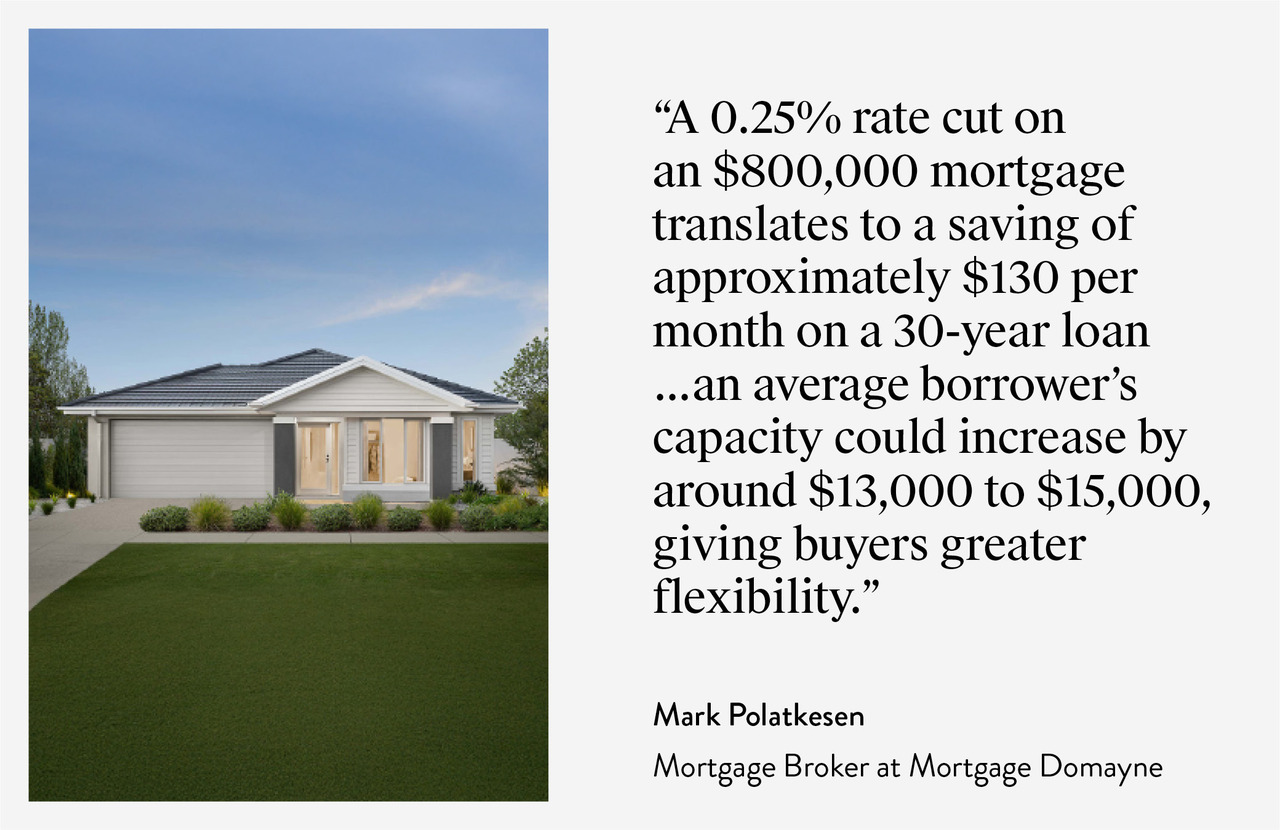

What a rate cut means for borrowers

Even a minor interest rate cut can make a meaningful difference for those borrowing for a new-build or a house-and-land package. A lower interest rate means reduced monthly repayments, making homeownership more manageable over the long term.

Additionally, increased borrowing power could expand the options available, whether that’s choosing a larger block, upgrading finishes, or selecting a more desirable location.

“A 0.25% rate cut on an $800,000 mortgage translates to a saving of approximately $130 per month on a 30-year loan,” says Polatkesen. “Additionally, an average borrower’s capacity could increase by around $13,000 to $15,000, giving buyers greater flexibility when searching for a property or considering upgrades and inclusions.”

With interest rates set to drop, now is the time to plan your new home build.

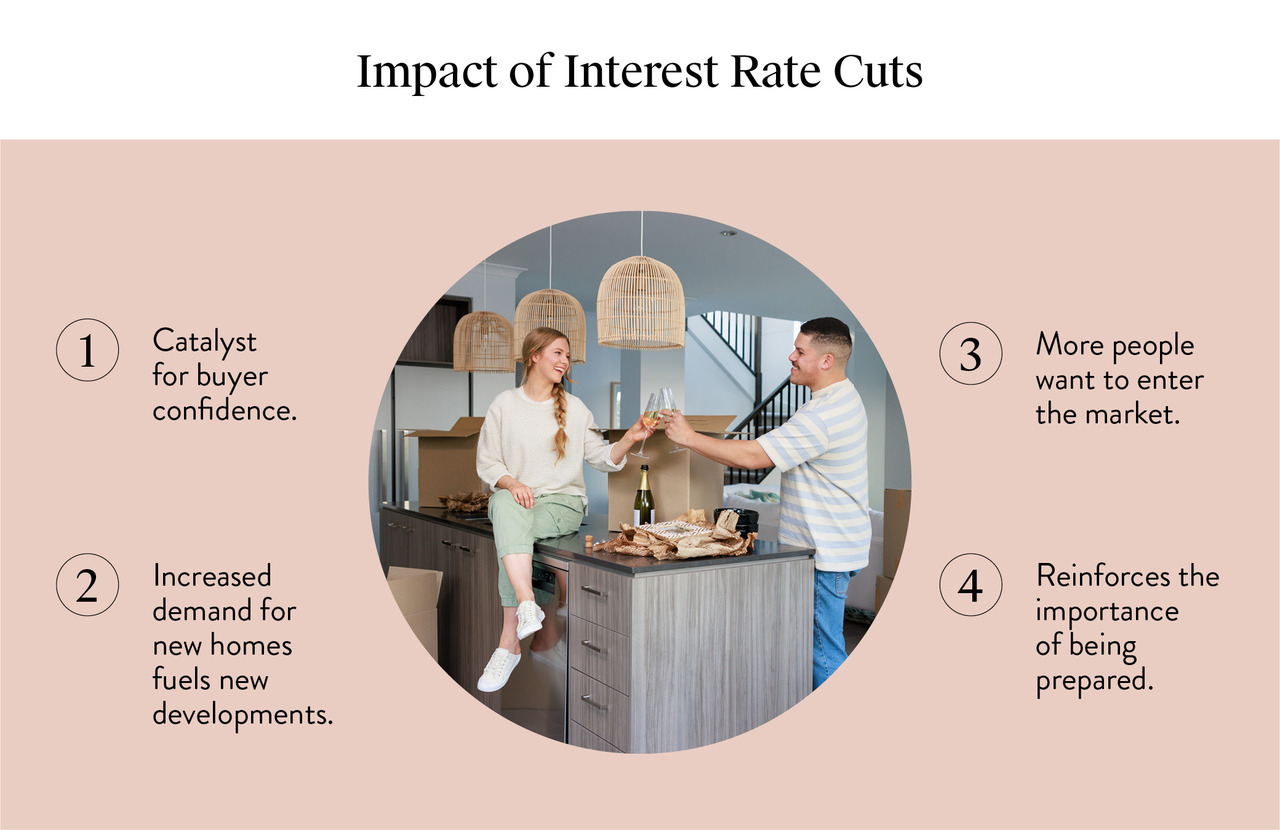

Impact on the homebuilding industry

Interest rate cuts often act as a catalyst for buyer confidence, sparking increased demand for new homes. When borrowing becomes more affordable, more buyers enter the market, looking to secure land and build their dream home. This surge in activity can drive momentum across the homebuilding industry, fuelling new developments and creating a vibrant, competitive market.

“What I’ve seen happen in the past is that confidence improves, and more people want to enter the market,” Polatkesen notes. “This can sometimes impact on construction starts, but Carlisle Homes ensures peace of mind on this front, with industry-leading build times.”

For buyers considering a new build, this uptick in demand reinforces the importance of being prepared and securing their position early. Locking in a home and land package sooner rather than later can help avoid potential delays and ensure they’re ready to take advantage of the renewed market energy.

Election year considerations

With a federal election due to take place before the middle of the year, housing policy is expected to be a key issue, as has played out over the past several election cycles. While some grants or incentives may be revised, a major overhaul is unlikely given the current housing undersupply.

“If anything, we may see increased incentives aimed to boost homeownership, particularly for first-time buyers,” Polatkesen says. “Regardless of the outcome, stability in housing policy will be crucial for maintaining confidence in the market.”

Tax cuts and borrowing power

Elections can also often spark discussions around personal tax cuts, but so far, that conversation hasn’t gained significant traction. With the mid-2024 tax cuts already providing some relief and boosting borrowing capacity for many Australians, there appears to be less urgency for further changes—at least for now.

“For a household earning $180,000 combined ($90,000 per person), those last round of tax cuts could see borrowing power increase by about $50,000,” Polatkesen explains. “This can provide more opportunities for buyers to enter the market or upgrade their home from the same time a year ago.”

Looking to make the most of 2025’s interest rate cuts? Now is the time to take control of your homeownership journey. Whether you're buying your first home or upgrading to your dream build, lower interest rates could mean lower repayments and greater borrowing power. Start planning today with Carlisle Homes' finance calculators and see what’s possible.