Interest Rates: What’s Next in Store?

It’s no secret that interest rates are rising. With the next cash rate decision released on Tuesday 6th of September, we break down what’s in store.

What is the cash rate and how does it affect your home loan?

The cash rate is set by the Reserve Bank of Australia (the RBA). It is used as a tool to manage inflationary pressure or to stimulate the economy when required.

The RBA has been steadily slashing the cash rate since November 2010, dropping it to a record-low of 0.10% in November 2020. This was in response to the effects of the COVID-19 pandemic, which saw the economy slow down as a result of widespread lockdowns and job losses.

The Governor of the RBA, Dr Lowe, indicated that the low rates would stay in place until inflation rose above 3%. At his speech in 2020, he predicted that that wouldn’t be until 2023 at the earliest, and quite possibly 2024.

However, a range of factors have seen inflation climb more sharply, and earlier than predicted. In response, the RBA have removed their ‘emergency settings’ and raised the rate to compensate.

We outline how to prepare for home loan rises to give you the information you need to make an informed decision about buying.

How high will interest rates go?

It all depends on inflation, but Dr Lowe has strongly signalled that Australians should be prepared for further increases. The RBA now predicts that inflation will surge to at least 7% by the end of 2022, and the cash rate may peak at 2.5%.

It’s worth noting that Dr Lowe’s comments were made in June when inflation was at 5%. The latest inflation figures, released Tuesday 26 July, were already up to 6.1%. That’s the fastest annual pace since 2001, with Australians noticing a difference in the petrol pump, supermarket checkout, and on their power bills.

The RBA’s target for inflation remains within the 2%-3% band but getting there may take some time. One of the unique things about the current situation is that the domestic economy only tells part of the story. High though Australia’s inflation rate is, it lags behind most of its trading partners. New Zealand recorded a 7.3% increase in the June quarter, while both the UK and US posted 9% rises and the Eurozone came in at 8.3%. Global supply chain issues and the Russia/Ukraine war have had a major impact on prices, along with widespread labour shortages.

Why does this matter? It may indicate that the RBA’s levers, on their own, don’t work as fast as people may hope. Certainly, nobody should expect the rate to drop any time soon.

Consider talking to your bank about refinancing to a lower rate if you have the option to help ease the blow. Featured here: Rothwell, Aurora Estate, Wollert.

What effect do the rises have on your home loan?

If the cash rate rises to 2.5%, as widely predicted, we can expect the banks and other lenders to hike their rates in response. For those with bigger loans, that could mean a lot of belt-tightening.

As of 6 July 2022, the cash rate is 1.35%, with average variable rates hovering around 3.65%. Assuming a rise to 2.5% as indicated, the variable rate would be 4.8%.

For those with a home loan of $500,000 on a 30-year term, they’ll be paying approximately an extra $336 per month, while many consider this in their home purchase rate rises do require attention to the household budget.

Use our Interest Rate Calculator to understand how changes in interest rates can impact your loan repayments.

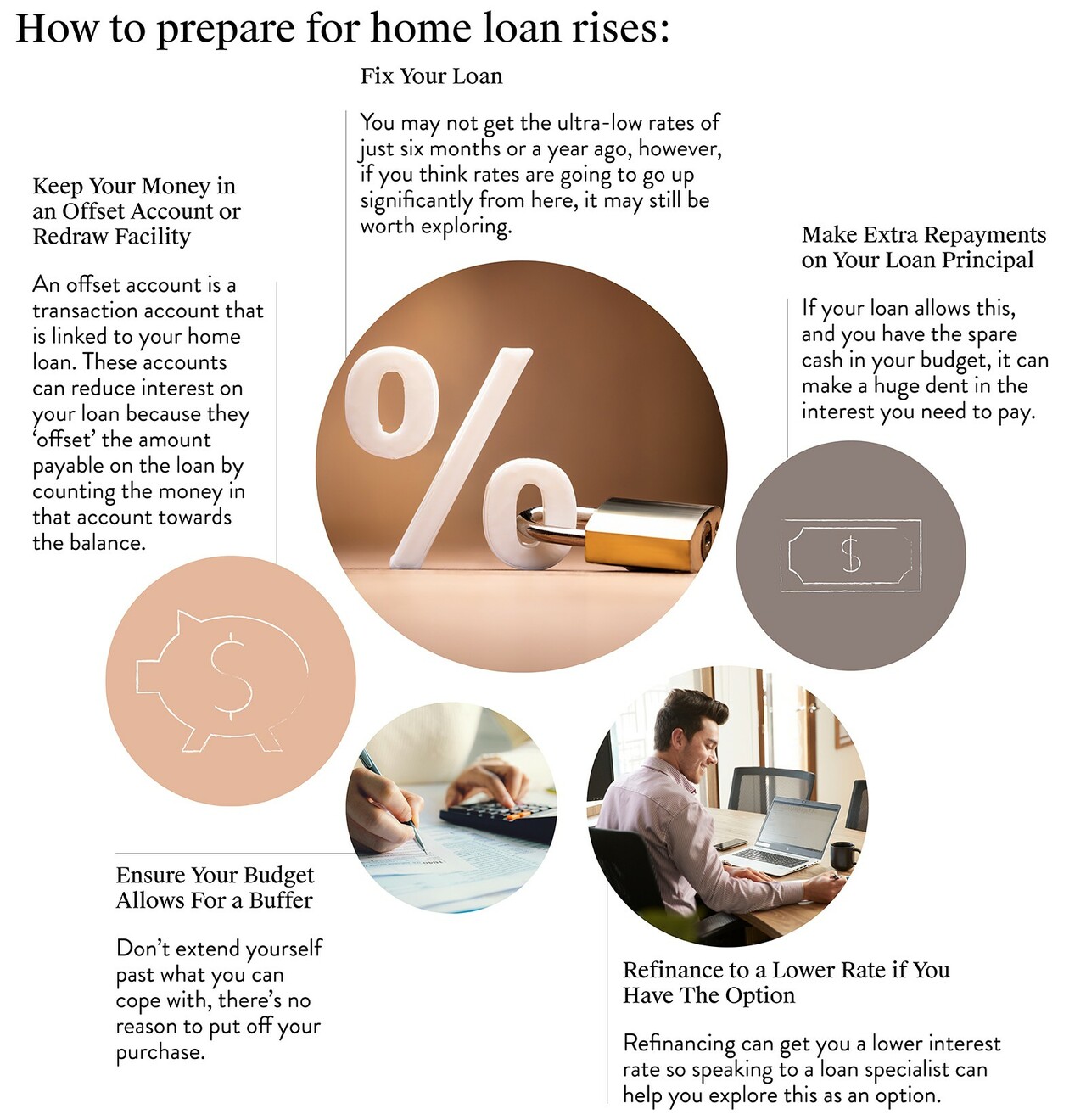

What can you do to cope with home loan rises?

If you haven’t already fixed your loan, is it too late? You won’t get the ultra-low rates of just six months or a year ago, where rates starting with two were common. However, if you think rates are going to go up significantly from here, it may still be worth exploring.

Currently, variable rates tend to be lower than available fixed rates. Banks do price in expected increases and are following the RBA predictions carefully. That said, Canstar has found fixed rates available from 4.38%, which may prove a bargain if the cash rate rises to 2.5%.

Other advantages of a fixed rate are that it allows budget certainty. For some households, that’s worth taking the risk.

Alternatively, consider whether any of the following options may help ease the blow:

- Making extra repayments on your loan principal. If your loan allows this, and you have the spare cash in your budget, it can make a huge dent on the interest you need to pay.

- Keeping your money in an offset account or redraw facility. This will also reduce the interest on your loan.

- Refinancing to a lower rate if you have the option.

The sooner you buy, the sooner you can start paying down the loan and building equity for financial security in the future!

Ready to buy the house and land package that suits your family? Call Carlisle Homes on 1300 328 045. Talk to our in-house construction finance specialists for advice on choosing the best home loan option for your needs.