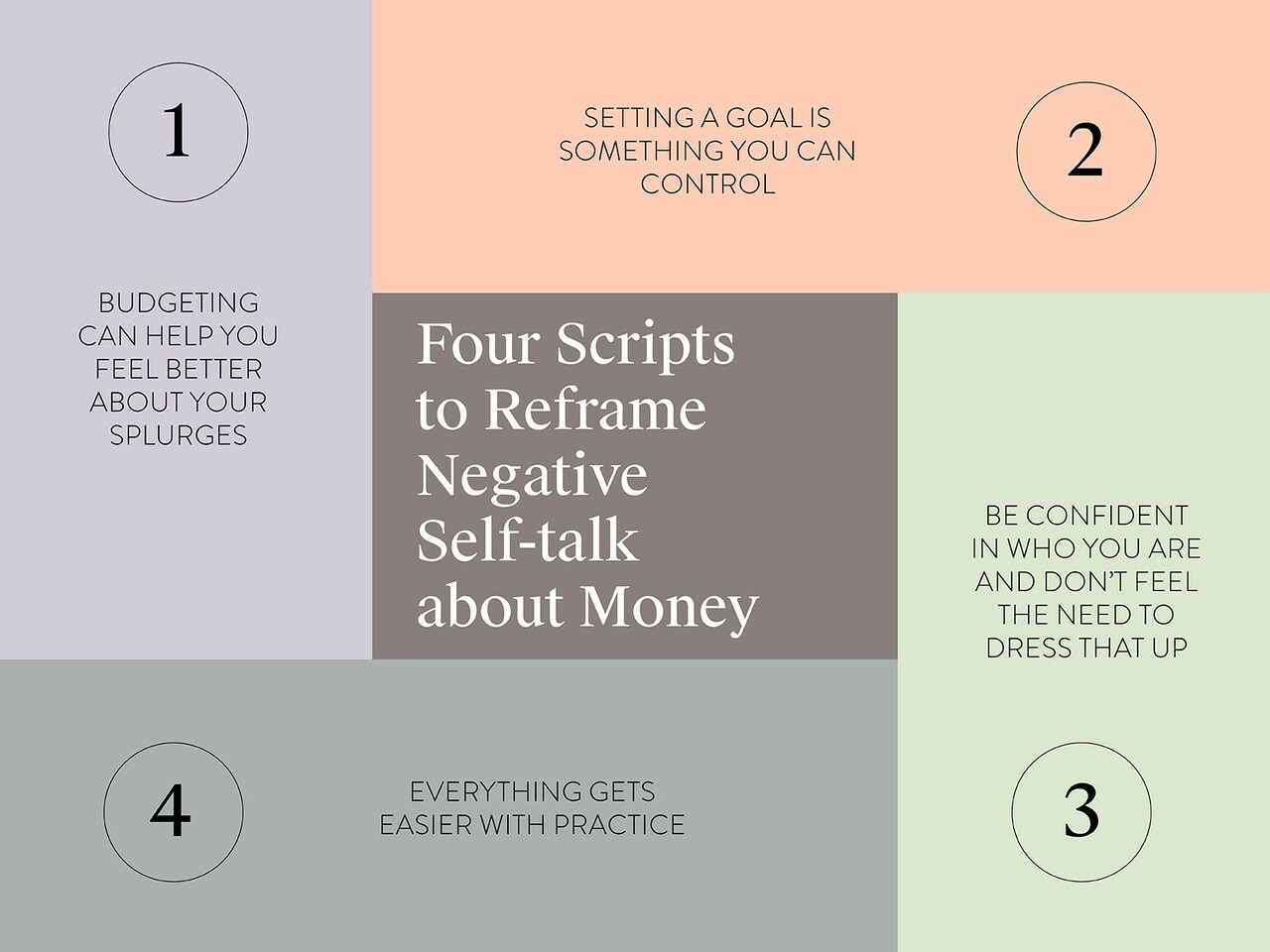

How to Reframe Negative Self-talk about Money

by Mark Polatkesen, General Manager - Mortgage Domayne

Is your money mindset letting you down? If you sometimes feel overwhelmed by the prospect of budgeting or saving, these motivational tips will help you change your mindset and achieve your goals.

“I’m bad with money.” “I don’t have a head for numbers.” “I know I should budget, but what’s the point? I’ll never afford a house.”

If any of the above sounds familiar to you, your money mindset might be letting you down.

Negative self-talk about money is very common and can have real consequences. If you believe you’re bad with money, or that budgeting is hard, you’re less likely to give it a try. People who approach their finances with confidence are more likely to call around for better deals, engage with financial advice and face up to past financial mistakes.

When that little voice in your head starts tearing you down, try these mindset scripts to push back and get motivated.

Negative self-talk about money is very common and can have real consequences so when that little voice in your head starts tearing you down, try these mindset scripts to get motivated.

“Budgeting can help me feel better about my splurges”

We all splurge from time to time. Sometimes, though, we can find ourselves in a ‘binge-repent’ cycle that can take a real toll. If spending money gives you a dopamine hit, there’s no need to cut everything back to the bone. You can use your budget as a tool that works for you.

One option that works well for impulse spenders is to quarantine the money you need for necessities. Set up direct debits to come out on your payday that covers your rent or mortgage, bills and a set amount for savings. Whatever’s left over is for you to spend as you please. That way, you can still indulge your impulsive side without the morning-after regret.

“Setting a goal is something I can control”

Feeling like you’ll never get ahead is about helplessness. You’re telling yourself that the game is rigged and there’s no point playing. You’ll never get a better paying job, the housing market is too expensive, and you weren’t born into generational wealth - factors outside of your control are stopping you from being rich.

To flip the script, look at what you can control. If it’s about work, can you retrain or ask for a promotion or a pay rise? If you feel like you’re living from pay to pay, are there ways to cut expenses and start stashing something aside? Having a plan and setting goals is the first step to feeling more powerful - and that’s what this script requires.

Building wealth doesn’t have to happen all at once. At its simplest, sorting out your finances is about knowing what you earn and what you spend.

“I am confident in who I am, and I don’t need to dress that up”

There’s nothing negative about wanting a luxury car or a sharp suit, or the latest iPhone. However, this script is all about self-confidence. People who want the appearance of wealth often doubt themselves underneath. They’re afraid that driving a 10-year-old car or wearing last season's clothes will make others think less of them. To avoid that happening, they spend beyond their means.

A better approach is to believe in your own self-worth - no matter what your net worth is. True friends won’t like you any less if you can’t afford 5-star restaurants, and your boss isn’t going to value your work more if you rock up in a Porsche.

“Everything gets easier with practice”

If you dive straight into the world of investments and loans, it can feel overwhelming. But building wealth doesn’t have to happen all at once. At its simplest, sorting out your finances is about knowing what you earn and what you spend. Even if you hated maths in high school, basic budgeting is as simple as addition and subtraction.

Rather than trying to do it all at once, break the task down into steps:

- List your expenses and income in one place so you can see what you’re spending.

- Make a list of any debts and how much they’re costing you per month.

- Write down any savings goals you may have (for example, a house deposit) and how much you have to put towards them each month.

Done all of that? You’re already a long way down the path towards sorting out your finances.

If you want to research loan structures, credit card deals or investment options, you can. It is also perfectly possible to be in charge of your finances and never know your stocks from your shares or an offset from a redraw. For extra help, get in touch with our in-house finance specialists, they’ll explain your options in a way that’s easy to understand.

Mark Polatkesen

General Manager - Mortgage Domayne

With over two decades of experience in the finance industry, Mark Polatkesen leads Mortgage Domayne, one of Australia’s largest construction-focused mortgage brokerages.

Read more