How Do You Finance a Knock Down Rebuild?

by Mark Polatkesen, General Manager - Mortgage Domayne

So, you’ve decided to embark on a knock down rebuild so you achieve your modern, energy-efficient dream home and stay in the neighbourhood you love. But how do you finance it? Carlisle’s in-house financing expert reveals all.

A knockdown rebuild project gives you the best of both worlds – create a beautiful contemporary home that fits your family’s needs, while staying put in the area where friends are close by, the kids are settled in school, and you’ve built your life. Not to mention saving you on stamp duty by staying where you are.

Carlisle Homes is Melbourne’s knockdown rebuild specialists and have perfectly crafted home designs specially tailored to suit these types of projects.

If you are considering a knock down rebuild and have questions around your financing options including whether you need a special type of home loan, Mark Polatkesen, Director and Senior Mortgage Broker at Mortage Domayne, Carlisle Homes’ in-house financial specialists, has the answers.

Mark Polatkesen, Director and Senior Mortgage Broker at Mortage Domayne, shares tips for construction loans specifically for knock down rebuild projects.

What type of home loan do you need?

“Most people choose a building and construction loan for knock down rebuild projects as these allow you to draw funds in stages that align with the construction process of your new build. These are called progress payments. For example, when your contract begins, when the builder lays the concrete slab for your new home, at the end of the framing stage, and when your home is completed you will be required to make a progress payment.

“A building and construction loan therefore saves you money, as you are making interest only payments until the loan is fully drawn.

“Be aware that most banks and lenders need you to have a building contract signed with a licensed builder before you can apply for a construction loan,” says Polatkesen.

How are you assessed for a construction loan?

“Lenders will use a loan-to-value ratio (LVR) combined with an income test to work out how much you can borrow,” says Polatkesen. LVR is the percentage of the loan amount compared to the property value of your home. Typically, lenders are comfortable with an LVR of up to 80 percent, meaning you’ll need at least a 20 percent savings deposit. But if you have enough equity in your current home, you may not need a deposit at all.

“For a knockdown rebuild, lenders will look at the value of your existing land plus the new, completed home and its property value. So, if your current property is worth $1.1 million, but $100k of that is the house that is being demolished, they will put the land value at $1 million. If you have a $500k building contract for the new house, they will then add that to the final market value, putting it at $1.5 million. Assuming you don’t have a mortgage, they may then lend you $500k against that $1.5 million value,” he says.

Sorting out your finances for a knock-down rebuild could be easier than you think.

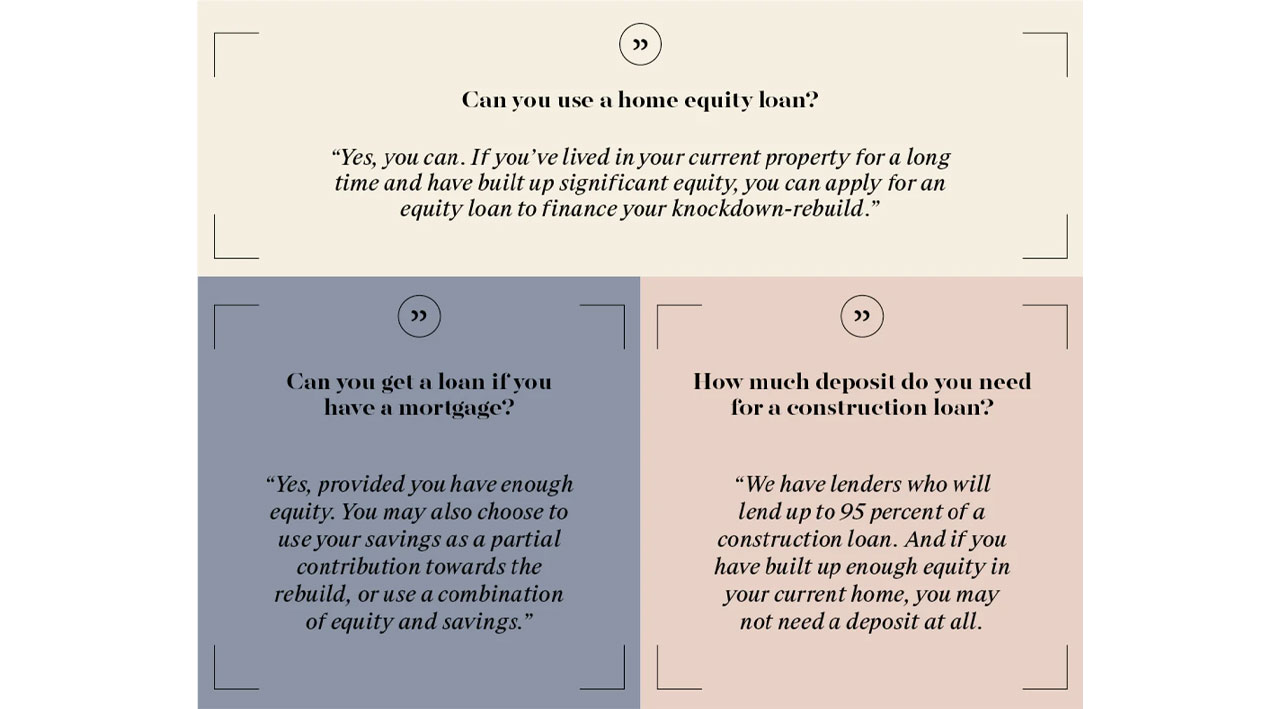

How much deposit do you need for a construction loan?

“We have lenders who will lend up to 95 percent of a construction loan, meaning you might need as little as five percent. And if you have built up enough equity in your current home, you may not need a deposit at all,” says Polatkesen. “This means the bank will lend you one hundred percent of the construction value, based on your existing amount of equity. This is a strong financial position to have!

However, if you are borrowing more than 80 percent of the property’s value as aforementioned, you’ll likely need to pay Lenders Mortgage Insurance (LMI). LMI is a one-time insurance premium that protects the lender in case you default on your loan. While this cost can add to your overall expenses, some lenders allow you to capitalise the LMI, meaning it can be added to your loan amount and repaid over time. This can be helpful if you want to borrow as much as possible while keeping your upfront costs lower.

“Builders typically require some form of deposit when you sign your building contract – this is generally around five percent. If that’s the case for you and you’d prefer to retain as much of your savings or deposit as possible and only use equity, we can often get that money reimbursed to you at a later point in time,” he says.

Use our Home Loan Calculator to explore different financing options for your knockdown rebuild project.

Can you get a loan if you have a mortgage?

“Yes, provided you have enough equity, you can continue to work with your current home loan, and just add the knockdown rebuild cost on top of that,” says Polatkesen. “You may also choose to use your savings as a partial contribution towards the knockdown rebuild, or use a combination of equity and savings.”

“Another option is to refinance your existing home loan. This involves renegotiating a new loan with your current loan facility or lender, often at a lower interest rate, and incorporating the cost of your rebuild into the new loan amount,” he says.

Can you use a home equity loan?

“Yes, you can,” says Polatkesen. “If you’ve lived in your current home for a long time and have built up significant equity, you can apply for an equity loan to finance your knock down rebuild with your current lender. This involves borrowing against the value of your existing property to fund your new build. If you have enough equity in your current property, you may find it’s enough to fund the entire rebuild project, including demolition, fencing, landscaping and even furniture.

“One important thing to remember: when assessing how much equity you have in your property, you can’t include the house value in its current form as it won’t exist after demolition.

“With a knockdown rebuild, when assessing how much equity you have in your home, the bank or lender will work on your site value plus the value of the new construction – in other words, your building contract with its plans and specifications, which is the capital that will improve the value of your property.

“Also, if you choose a home equity loan, be aware that interest rates will kick in immediately,” says Polatkesen. “This is an important consideration in a market where interest rates rise consistently.

There are different ways to approach home loans for knockdown rebuilds, Mortgage Domayne broker Mark Polatkesen shares the ins and outs.

What’s good to know about valuations?

“It’s worth noting that property valuations can vary between lenders,” says Polatkesen. “This is particularly true in established areas where you’re putting in a brand-new home, and don’t have any recent sales to compare it to. Without enough data available, lenders may simply end up comparing your property to one that’s 10 or even 20 years old – and as we know, the older established homes get, the more they depreciate in value.

“If you’re not getting the valuation you want or need, it’s worth getting another valuation done before putting in your loan application, which is something a mortgage broker can arrange for you. At Mortgage Domayne, we’ve seen variations of up to $250k on the same property, which is very significant,” he says. These variations in value can potentially save your thousands in interest payments.”

Need help navigating a home loan for your knockdown rebuild project?

Carlisle Homes offers an in-house finance team who offer specialist advice on finance for new home builds. They can help you work through your budget, assess the equity in your existing property and any other financial considerations to save you time, money and stress. Contact us for an obligation-free chat when you are knocking down and rebuilding.

Mark Polatkesen

General Manager - Mortgage Domayne

With over two decades of experience in the finance industry, Mark Polatkesen leads Mortgage Domayne, one of Australia’s largest construction-focused mortgage brokerages.

Learn more about Mark Polatkesen