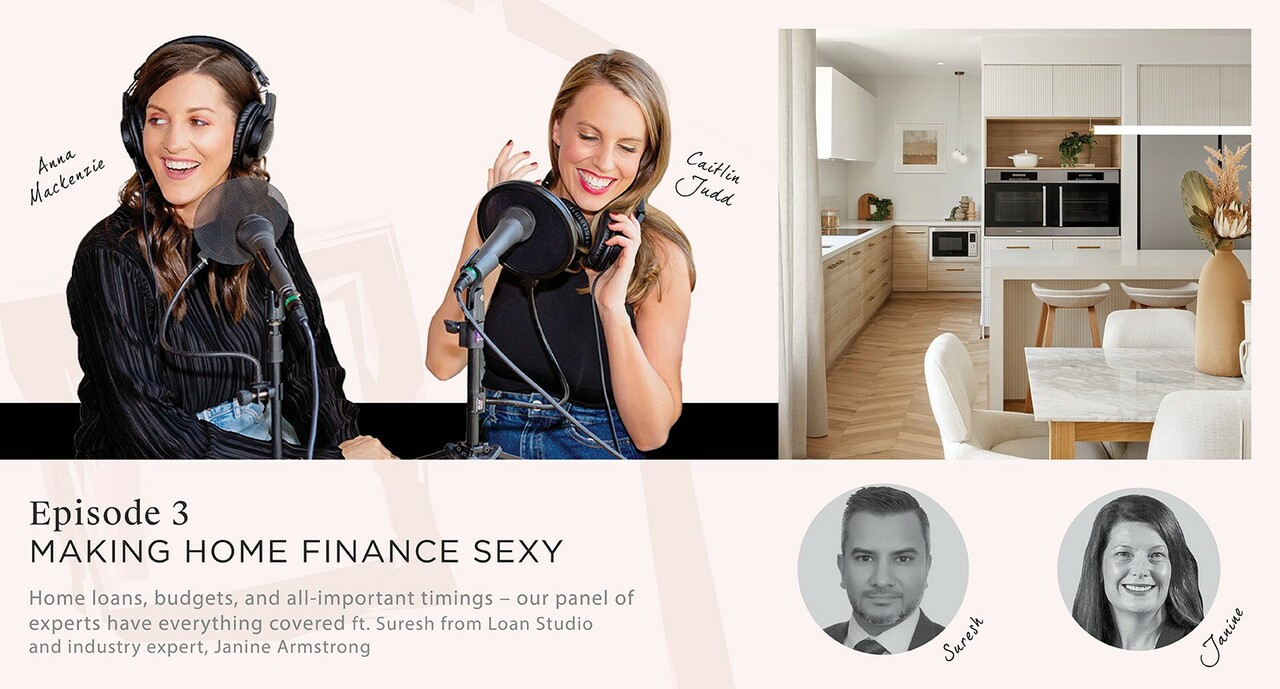

Home Files Podcast Episode 3: Making Home Finance Sexy

Home loans, budgets, and all-important timings – our panel of experts have everything covered in episode three of the Home Files Podcast series.

So you’ve found the perfect location for your Knockdown Rebuild and you’re picturing your new Carlisle home being built there. Now’s the time to work out all the financial details needed to bring your dream home to life.

In episode three of the Home Files Podcast, Caitlin and Anna, the talented founders of Lady-Brains, chat with Lending Manager Suresh Kandasamy from Loan Studio and industry expert Janine Armstrong from Carlisle Homes about home loans, financing your Knockdown Rebuild and key timings.

Listen to the episode here or read the highlights below.

Set your budget early

With a Knockdown Rebuild, it’s important to establish your budget early to determine the percentage you’ll need to allocate to your land (if applicable), home, wish list items and inclusions.

Financing a Knockdown Rebuild

Financing a Knockdown Rebuild is a little more complex and generally requires a different type of loan. If you’re purchasing an old home and knocking it down, your loan needs to account for both land and construction costs. For this reason, it’s important to speak with a construction home loan specialist early.

Different home loan types

The right type of home loan will depend on your situation – whether you’ve bought a property to knock down or you’re knocking down your existing property.

In both cases, the main factor that will determine how much you need to borrow is what your existing mortgage looks like as a percentage of the land value.

You are more likely to have sufficient equity to fund your build if you’re knocking down an existing home that you’ve owned for some time. If it’s a recent purchase, you will need to have well-planned equity or contribution to ensure there is enough to cover the build when it is added to the land value.

If you’re knocking down your existing home

You will need a construction home loan, which allows you to draw money from the loan throughout the construction process, while only paying interest on the amount you use.

A construction home loan provides up to 95% of the value of the land, plus the value apportioned to the build (Tentative of Construction Valuation). This 95% also includes Lender's Mortgage Insurance (LMI), so the maximum the bank will loan you is around 91% plus LMI.

If you’ve bought an older property to knock down

You will need a relocation (or bridging) loan. The amount you can borrow will depend on how much equity you have in your current property combined with the current market value.

Generally, the maximum banks will lend you is 80% of the land value, plus the value apportioned to the build. For this reason, relocation loans tend to be less popular than other home loans.

How do home loans work during construction?

When you engage a builder, you’re agreeing to make instalments at six key stages of the build.

The progress payment schedule is generally:

- Initial deposit (5%)

- Base stage (15%)

- Frame stage (30%)

- Lock-up stage (19%)

- Fixing stage (21%)

- Completion (10%)

Once your financing is sorted, you can get on with the fun part – designing and planning your new dream home!

You can listen to episode three of our Home Files Podcast here, or search ‘Home Files’ in your favourite listening app and hit ‘subscribe’ to catch each episode as soon as it drops.

Click here for Spotify Click here for Apple Podcast Click here for Google Podcast

Search ‘Home Files’ in your favourite listening app and hit ‘subscribe’ to catch each episode as soon as it drops.

Alternatively, you can download Carlisle’s Knockdown Rebuild information pack for a step-by-step guide to knocking down and rebuilding your dream home, as well as information on financing, different types of home loans and a useful expenses checklist.