Green Home Loans Explained

Have you heard about green home loans? These innovative home loans offer borrowers discounted interest rates for building an energy-efficient home – a win-win for your budget and the environment.

If you’re concerned about your carbon footprint and want to build a home that’s cheaper to run and kinder on the environment, a green home loan could be the ideal option. These loans reward buyers and renovators for minimising their environmental impact with reduced interest rates, access to government rebates and tax credits, plus additional funding for energy-efficient home upgrades.

And with all new Carlisle homes being seven-star energy-rated, you’ll have no trouble finding a home design that meets the criteria for a green home loan. Read on to learn more.

What is a green home loan?

A green home loan focuses on financing eco-friendly and sustainable home projects, including new build builds and renovations. They generally offer lower interest rates and incentives such as cashback rebates to incentivise sustainable building choices.

“With a green home loan, buyers can expect an average of 0.5% saving on their interest rate compared with a non-green home loan at the same bank, or 0.7% with major lenders, saving them around $290 on interest monthly on a $700k mortgage – and these discounts are for the life of the loan,” says Mark Polatkesen, Managing Director of Mortgage Domayne.

Kinder on the environment and your hip pocket, a green home loan gives you lower interest rates for the life of your loan, and access to government rebates and tax credits for building a sustainable home.

What would I need to build?

To qualify for a green home loan, you would need to build a home that’s seven-star energy-rated or higher under NatHERS (Nationwide House Energy Rating Scheme).

With Carlisle Homes, that’s easy. All new Carlisle homes are rated seven stars for energy efficiency, making them an ideal choice if you’re financing your build with a green loan.

Choosing a seven-star Carlisle home also means that you’ll get a home that’s more affordable to run, gentler on the environment, and packed with sustainable features that boost your property’s value.

All new Carlisle homes meet seven-star energy-efficiency standards, making them ideal for green home loans. Features like double glazing, premium insulation and passive heating and cooling are gentler on the earth and reduce your utility costs.

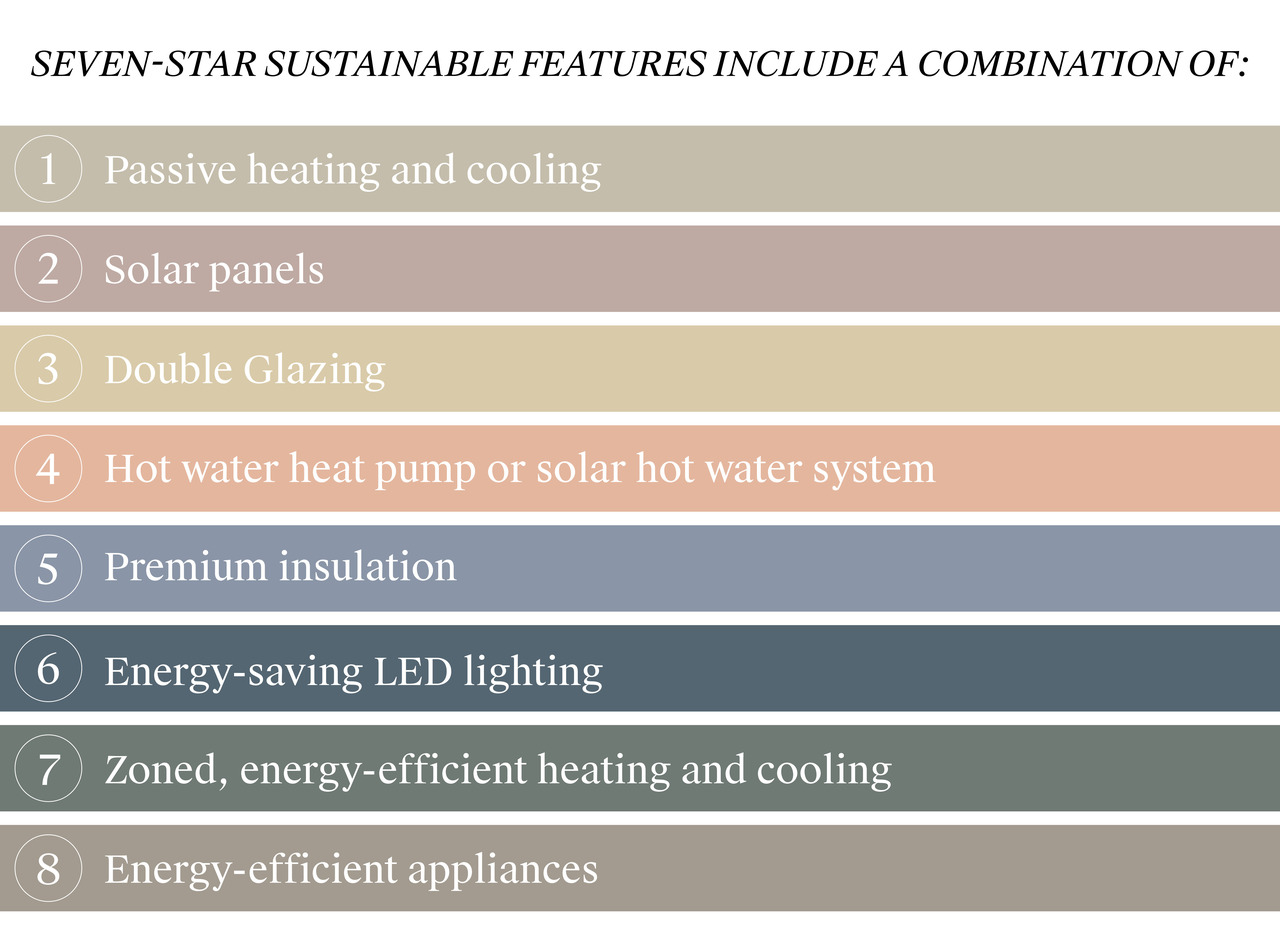

Seven-star sustainable features in your new Carlisle home include a combination of passive heating and cooling, solar panels, double glazing, premium insulation and LED lighting. You’ll also enjoy zoned, energy efficient heating and cooling, energy-efficient appliances, and a heat pump or solar hot water system.

Which lenders offer green home loans?

Several lenders in Australia offer green home loans to those who want to build an efficient, healthy home. “And given the strong demand for green home loans, we can realistically expect to see more lenders providing similar offers in the future,” says Polatkesen.

Current lenders include CommBank (Green Home Offer), Firstmac (Green Home Loan), Bank Australia (Clean Energy Home Loan) and Gateway Bank (Green Home Loan).

What about first home builders?

“Several of the above lenders are on the First Home Guarantee Scheme, which means that clients only need a five percent deposit to secure these reduced rates, provided they quality for the First Home Guarantee Scheme,” says Polatkesen. “At Mortgage Domayne, we can couple green home loans with no mortgage insurance for first home buyers, provided they qualify for the First Home Guarantee Scheme.”

How do I quality?

Eligibility varies between lender, so you’ll need to speak with your mortgage adviser about the specific requirements. But typically, lenders will want to see certification, such as a seven-plus star NatHERS rating, a seven-plus star Residential Efficiency Scorecard, a Passive House Certification, or a Green Star Rating.

Want to learn more about financing your Carlisle home with a green home loan? Pop into one of our 80+ display homes where you can chat with our in-house finance specialists, Mortgage Domayne. You can also contact Mortgage Domayne at enquire@mortgagedomayne.com.au or on 1300 328 045, or make an appointment to meet them at our Spectra Showroom in Mulgrave, Victoria.