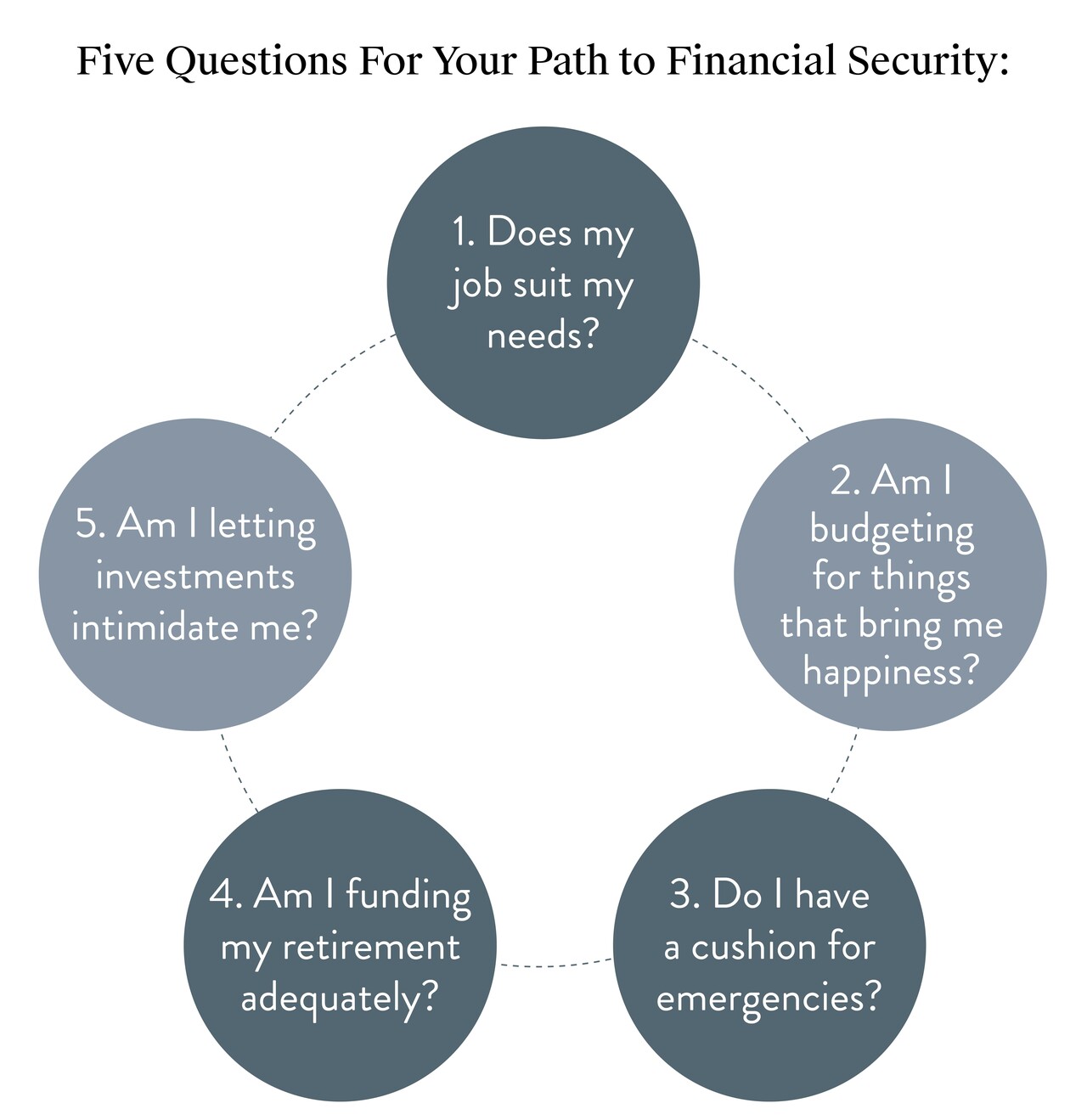

Five Questions for Your Financial Future!

Thinking about your financial state? Here are five questions you should ask yourself to prep for the future of your finances!

Here are five questions to ask to make sure you’re on the path to financial security.

1. Does my job suit my needs?

Your job is at the centre of your financial life. It brings in your salary and helps define your professional path into the future.

As circumstances change, though, it’s worth stepping back and asking if our careers still fit your lifestyle. Maybe you took on a job with a lot of travel before you had children, and now you want a job that lets you spend weekends with your family. Or you’ve skilled up but not yet turned that into a promotion. Whatever your circumstances, ask yourself if your job:

- Makes you happy

- Uses your skills

- Provides intellectual challenge

- Offers work/life balance

- Puts you on the path you want for your future

If you can’t answer yes to all of those questions, consider looking around. Australians are in a strong labour market at the moment, meaning this is the perfect time to take that leap.

By thinking about what you value, you won’t just save money: you’ll be investing in the future and the lifestyle you want to have.

2. Am I budgeting for things that bring me happiness?

Budgeting doesn’t have to mean denial. It’s about making sure you have room for the things that you really value.

For some of us, that might be holidays and other experiences. For others, good quality homewares or designer clothes might bring us happiness. Perhaps you value free time enough that hiring a cleaner or outsourcing the cooking makes sense to you. Or cooking is your favourite hobby, so high-end appliances are worth their weight in gold.

There is no right or wrong answer to this one: what we value is deeply individual. The important thing is that you do spend your money where it’s valued, other than wasting it on things you think you should own or spending out of habit. By thinking about what you value, you won’t just save money: you’ll be investing in the future you want to inhabit.

3. Do I have a cushion for emergencies?

Sometimes, to achieve your goals, you need to take risks. That is an easier prospect if you have saved some money for emergencies. Whether you want to start your own business, move to a bigger house, take a sabbatical, or invest in a renovation, you’ll feel easier knowing that there’s some money to fall back on.

Ideally, your emergency fund should have around three months’ living expenses saved in it. If that sounds too daunting, start small. Set up an automatic transfer to a savings account or term deposit that offers a good interest rate and is hard to withdraw funds from. Once it starts building up, you’ll find you have the motivation to continue.

Financial planners can help you decide what the best investment strategy is for your future. Start now and you’ll be able to enjoy financial security as you age.

4. Am I funding my retirement adequately?

If you’re young, it may seem like retirement is a million years away. If you’re older, it’s easy to feel that it’s too late to start funding your super. The trust is that the sooner you start paying attention to your superannuation, the better - but it’s also never too late.

The Superannuation calculator is a great place to find out if you’ll have enough to retire on when the day comes. You can adjust the settings to see how much difference a small voluntary contribution might make or compare returns from alternative funds.

5. Am I letting investments intimidate me?

Investments don’t need to be complicated. Even if you don’t know your stocks from your shorts or your blue chips from your blockchain, investing is a smart move for your future.

Financial planners can help you decide what the best investment strategy is for your future. They’ll go through your risk profile, long term goals and establish how much you’re comfortable investing at a time. Investment platforms and apps demystify the process and let you check in easily on how you’re doing.

Even a small amount, if invested wisely, can help you build wealth for the future. Start now and you’ll be able to enjoy financial security as you age.

Ready to hit that first financial goal? Talk to our in-house construction finance specialists.