Building Your Dream Home: Overcoming Borrowing Challenges

In today’s shifting financial landscape, securing the right loan to build your dream home can be daunting. With economic changes affecting borrowing power, expert guidance is essential to maximise home-buying options.

Carlisle Homes’ finance specialists excel in construction-specific loans and are knowledgeable about the latest government incentives. They’re ready to help you navigate these complexities and secure financing that expands your lending ability.

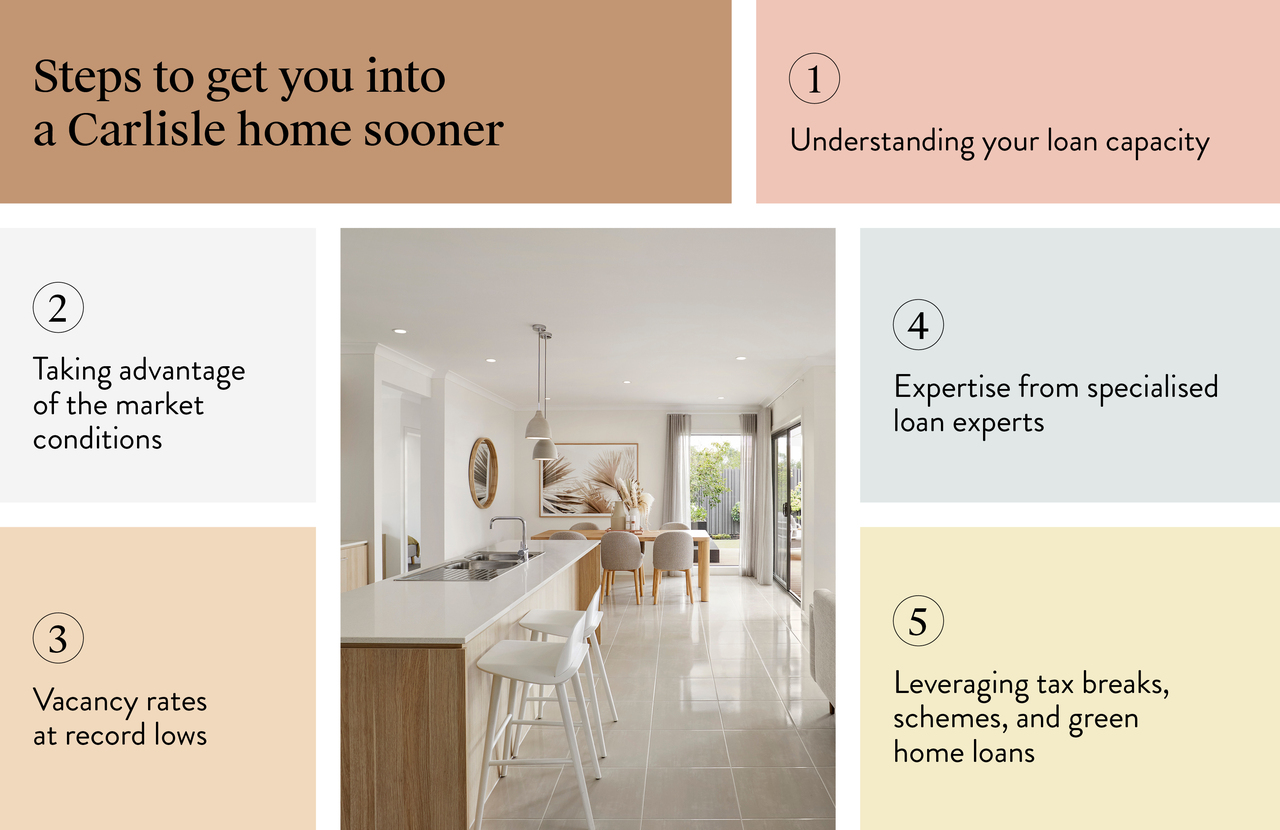

Read on to learn how current market conditions can work in your favour and the steps to get you into a Carlisle home sooner.

Unleash the power of your finances with expert guidance on tax cuts, government schemes, and green loans.

Current borrowing power challenges

Recently, many prospective homeowners have found their purchasing power significantly reduced. A few years ago, securing a loan that covered the total cost of building your ideal home was relatively straightforward.

However, with rising interest rates and tighter lending criteria, many now find that their borrowing capacity has decreased, potentially limiting their options.

This shift means that where customers once had the freedom to choose the size and style of their home, they now need to re-evaluate, prompting careful planning and expert advice to maximise their loan eligibility.

Household income and borrowing capacity

Understanding your loan capacity is crucial when determining what kind of home you can afford, and household income plays a significant role in this calculation. Lenders typically ensure that your repayments are at most 30% of your gross income.

For example, Carlisle’s entry-level house and land packages start around $600,000 to $650,000 across their East, West, and North house and land packages.

“With a 5% deposit on a $650,000 purchase, you’d need a loan of approximately $617,500—translating to roughly $853 in weekly repayments,” says Mark Polatkesen, Director and Senior Mortgage Broker at Mortgage Domayne.

“This scenario requires a two-person household income with each person earning at least $70,000 per year (assuming no children, no debts, and subject to meeting the eligibility of the First Home Guarantee scheme) to meet the benchmark lenders use to assess affordability,” Polatkesen advises.

Understanding these criteria and planning effectively to increase your borrowing capacity is essential, offering you the broadest range of home choices.

Market conditions and right timing

Despite current financing challenges, market conditions offer a unique opportunity for homebuyers. With interest rates forecast to decrease and land prices at a low point, now is an ideal time to act.

“For a family or couple targeting a $650,000 home purchase, each 0.25% rate reduction will improve borrowing capacity on average by about $12,000 to $14,000, enabling them to consider a home with the extra bit of square metreage,” says Polatkesen.

Taking advantage of these conditions before the market rebounds could help you secure lower property prices and benefit from future gains. By starting the process now, you may also align your first repayments with the anticipated lower rates, maximising your financial advantage.

Seize the moment - boost your lending capacity and unlock your dream home with Carlisle.

The advantage of specialised loan experts

Financing a new home build requires specialised expertise that not all brokers possess. Construction, new build, and house-and-land package financing involve unique challenges, from split contracts to staged payments and government incentives.

“With a specialisation in construction and new home finance, we’re perfectly positioned to guide you through the process,” says Polatkesen. “From navigating reduced stamp duty and qualifying for exemptions to facilitating the First Home Guarantee scheme and taking advantage of green home loans, we can help you make the most of these opportunities as you enter the market.”

Unlike general brokers, specialists in this field understand these complexities. Carlisle Homes’ finance team brings this expertise, ensuring you receive tailored advice to maximise your borrowing power and secure the proper loan structure for your needs.

Renting versus buying

When deciding between renting and buying, cost is often the key factor. With rental prices soaring and vacancy rates at record lows, the financial and security benefits of buying are increasingly evident.

For instance, renting a four-bedroom home in Clyde North might cost around $650 per week, while mortgage repayments on a similar new build in Carlisle’s Meridian Estate could be approximately $850 per month.

This comparison underscores the viability of leaving the rental market for homeownership, with the benefit of long-term capital growth potential.

Buying your dream home can come with unexpected expenses. Our House Buying Cost Calculator helps you anticipate these costs, giving you a clearer financial picture as you plan your project.

Transform financial challenges into opportunities with bespoke lending advice and guidance.

Leveraging tax breaks, schemes, and green home loans

“Government and financial incentives can significantly increase your funding capability,” says Polatkesen. “The recent tax cuts, effective from 1st July 2024, could add to the borrowing capacity for couples, plus green home loans like the Bank Australia Clean Energy home loan offering rates as low as 5.98% for 7-star energy-rated homes (6.42% comparison rate, and subject to meeting lender criteria), also provide an excellent opportunity to boost your borrowing potential.”

Additionally, government initiatives like the First Home Guarantee scheme further enhance affordability by waiving lenders’ mortgage insurance (LMI) costs for eligible buyers. “For example, on an $800,000 purchase with a 5% deposit, this waiver saves you $30,000 to $35,000, effectively shifting that saving from your purchase costs to your loan capacity,” Polatkesen explains. Read more here for further details on the 2024/25 financial year scheme.

Ready to turn your homebuilding dreams into reality? Visit one of Carlisle’s 80+ display homes across Melbourne to see firsthand how an award-winning Carlisle floorplan can save you money and energy. Book your visit today to turn your vision into a reality!