Build Your First Home With a 5% Deposit: Here’s How

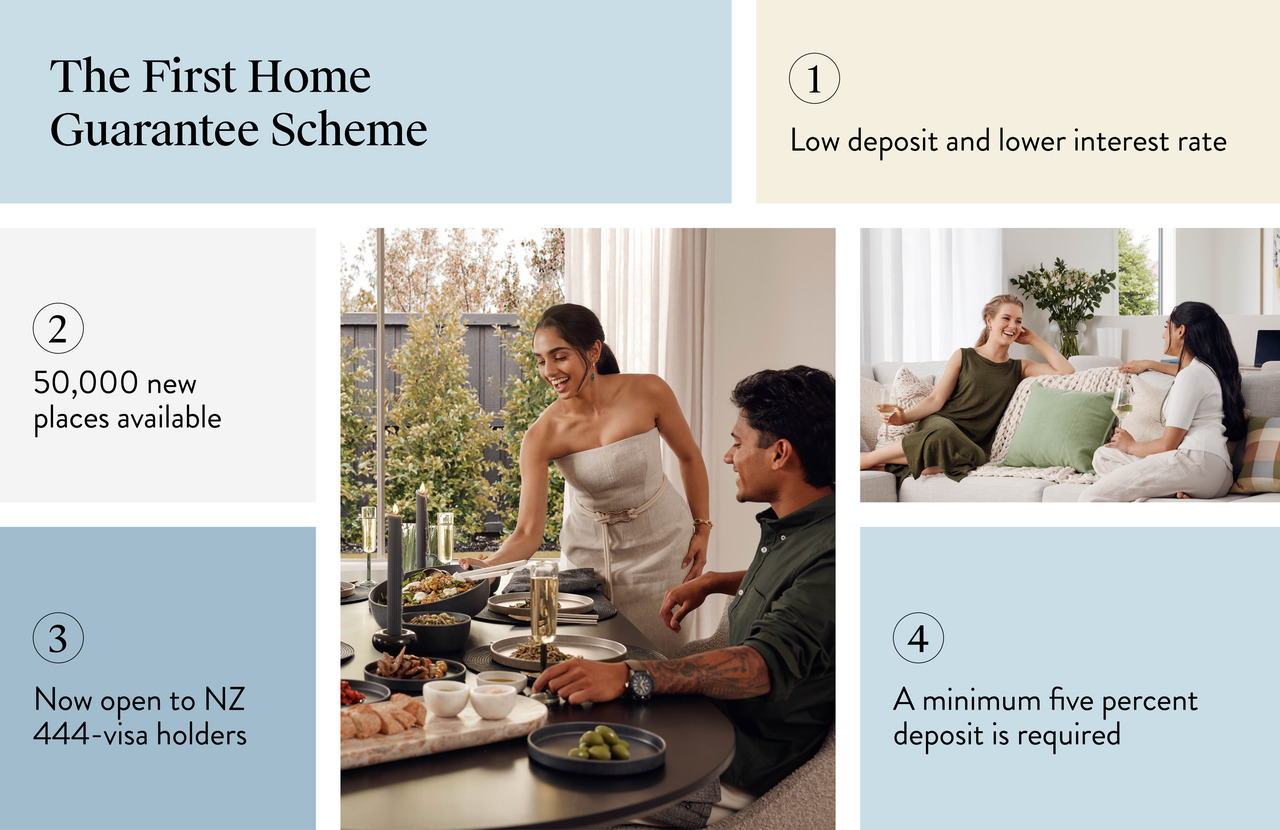

The government’s First Home Guarantee scheme helps first homebuyers get into their own home for less, and they’ve just announced 50,000 new places for the 2024/25 financial year. Here’s everything you need to know.

Getting into your first home may feel like an impossible challenge, but the government is making it easier with their First Home Guarantee scheme. They recently announced 50,000 new places on the scheme for the 2024/25 financial year, making homeownership more accessible for first-time buyers, single parents and those in regional areas wanting to break free of the rental system.

Mark Polatkesen, Director and Senior Mortgage Broker at Mortage Domayne, Carlisle Homes’ in-house financial specialist, explains more about the scheme and how you can secure your spot.

Benefits of the First Home Guarantee Scheme

“The First Home Guarantee Scheme, which is administered by Housing Australia, helps first homebuyers, single parents and those in regional areas build or buy their own home with a very low deposit, while avoiding the Lenders Mortgage Insurance usually associated with purchases above an 80 percent loan-to-value-ratio,” says Polatkesen.

Beyond the benefit of a low deposit, eliminating mortgage insurance can be a huge cost saver. “As an example, the cost of mortgage insurance on a purchase price of $800,000 with a five percent deposit usually ranges from around $30,000 to $35,000. This fee is waived under the scheme.

“Another benefit for those buying through the scheme is that lenders will also apply a lower interest rate as these are backed by the government by way of guarantee. The Westpac rate at 95 percent is 7.00 percent, however this reduces to 6.30 percent under the First Home Guarantee Scheme – and this lower rate also improves your borrowing power,” he says.

Users can also use our Deposit Savings Calculator to help calculate how much they need to save for a minimum deposit.

50,000 new places available

The government recently announced that 50,000 new places are available on the scheme for the 2024/25 financial year.

These places fall within three schemes.

First Home Guarantee scheme: For the FY2024/25, there are 35,000 places to support eligible buyers purchase a home sooner with a deposit as low as five percent and without paying Mortgage Lenders Insurance.

Regional First Home Buyer Guarantee: There are 10,000 places available on this scheme for FY2024/25. It helps buyers purchase home in a regional area with a deposit as low as five percent and without paying Mortgage Lenders Insurance.

Family Home Guarantee: This scheme helps eligible single parents and single legal guardians of at least one dependent buy a home with as little as two percent deposit and without paying Mortgage Lenders Insurance. There are 5,000 places for FY2024/25.

Now open to NZ 444-visa holders

“Another great addition to the scheme is that it’s now open to New Zealand citizens holding a sub-class 444 visa, which is the visa granted to all New Zealand citizens when they arrive in Australia,” says Polatkesen.

“Prior to this change, first home buyers from New Zealand buyers would need to pay the five percent deposit, plus mortgage insurance, which would be around $75,000 to $80,000 on an $800,000 purchase. Under the scheme now, the cost to buy their first home comes down to around $40,000 for an $800,000 purchase,” he says.

The nuts and bolts

Eligible applicants need to be 18 years or older and an Australian citizen, an Australian permanent resident or a NZ sub-class 444 visa holder. All these schemes have an annual income cap of $125,000 for singles and $200,000 for joint applicants. Applicants must intend to be the owner-occupier of any property purchased through the scheme.

First Home Guarantee scheme: This scheme is open to first home buyers and people who haven’t owned a home in the last 10 years. It is also open to two applicants broadly, such as friends, siblings or other family members to make a joint application. The price cap for homes in Melbourne is $800,000. A minimum five percent deposit is required.

Regional First Home Buyer Guarantee: Open to first home buyers and those who haven’t owned a home in the last 10 years. It is also open to two applicants broadly, such as friends, siblings or other family members to make a joint application. Homes need to be in a regional part of Australia, with a price cap in regional Victoria of $650,000. A minimum five percent deposit is required.

Family Home Guarantee: This initiative is open to single parents or legal guardians with at least one dependent living with them. It is open to people who have previously owned a home, but not to those who current own a home or a commercial or investment property. House prices in Melbourne are capped at $800,000 and at $650,000 in regional parts of Victoria. A minimum two percent deposit is required. As a single parent or legal guardian, the applicant must be the only name listed on the loan and certificate of title.

Top tip

With only 50,000 places available, you’ll no doubt want to act quickly to secure your spot. But it’s important to be aware of the scheme timings, advises Polatkesen; “Allocations for the First Home Guarantee Scheme only last 90 days, so it’s a good idea to submit your request close to your settlement date or when your land titles. If the allocation expires before your land titles or your settlement date, we would then need to reapply for the scheme,” says Polatkesen.

How to apply

First, check your eligibility for the First Home Guarantee Scheme. Then find a participating lender (Mortgage Domayne, Carlisle’s finance specialist, works with many of them). Finally, submit your application to Housing Australia through your lender.

Want to learn more about the First Home Guarantee Scheme and if it’s right for you? Pop into one of Carlisle’s 80+ display homes and have a chat with their in-house financial specialist, Mortgage Domayne. You can also contact Mortgage Domayne at enquire@mortgagedomayne.com.au or on 1300 328 045, or make an appointment to meet them at Carlisle’s Spectra Centre in Mulgrave, Victoria.