4 Steps to Save Money on a Modest Income

Struggling to save? We’ve found some easy ways to cut spending and watch your savings grow.

Saving is satisfying when you can see the cash piling up in your bank account. But for those of us who have to watch every cent, it can feel like a slog. If a takeaway latte, new lipstick or camping weekend are the only luxuries you can afford, do you really want to give them up?

You may not have to. By taking a careful approach to saving and getting clear on your priorities, you can save and still enjoy life. These simple steps will help you cut the fat without losing out.

By taking a careful approach to saving and getting clear on your priorities, you can save and still enjoy life

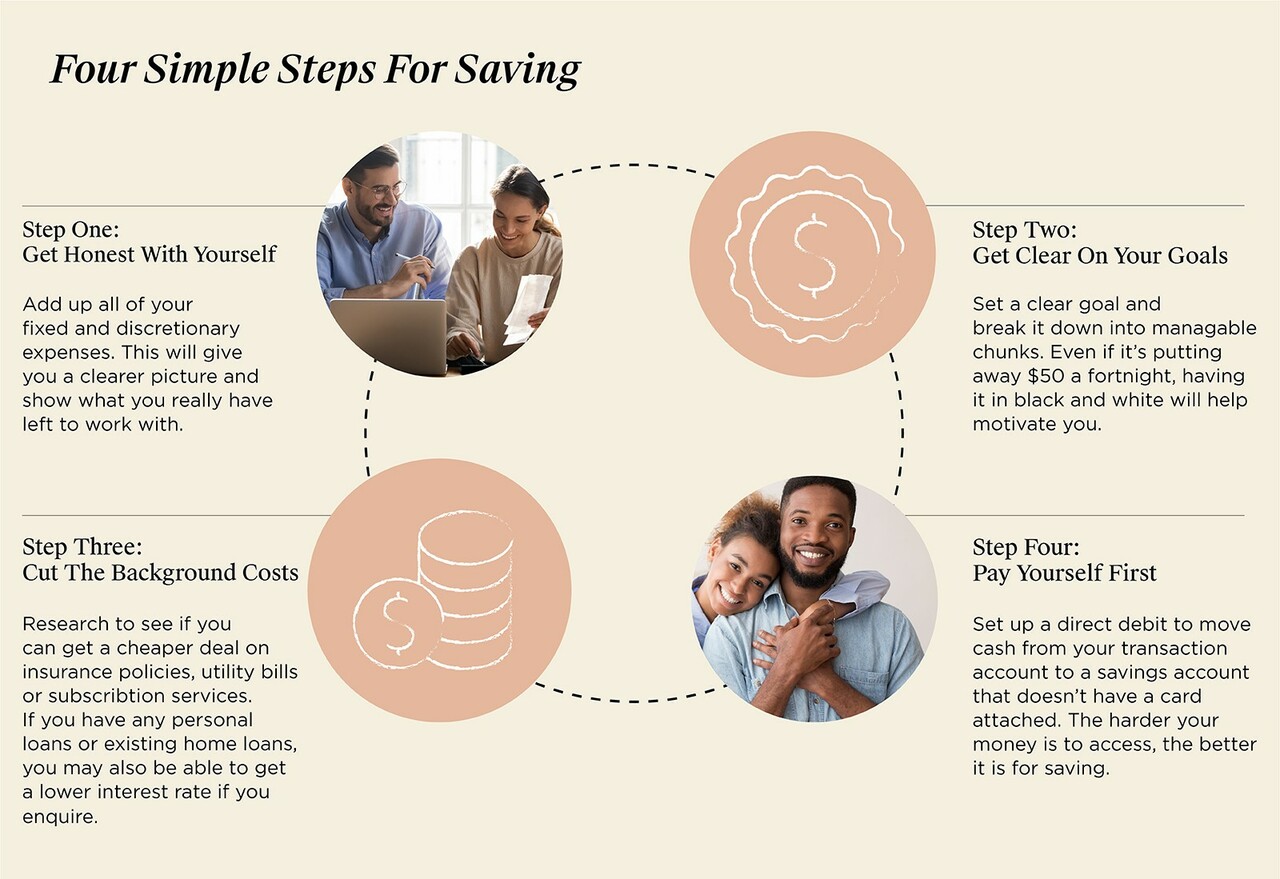

Step One: Get honest with yourself

Knowledge is power, so get comfortable and confront your finances. It’s vital that you know exactly where your money is going.

Add up all your fixed expenses first. These are the ones you have to pay, such as rent, utilities and loan repayments.

Next, add up all your regular discretionary expenses. This includes anything you pay regularly or occasionally but could drop if you had to. Think gym memberships, streaming services, clothes and entertainment. This is the area where you need as much transparency as possible. Look at your last six or 12 months of bank statements to see what you really spend. If you’re shocked by the number of Uber Eats orders or how much you really spent on computer games, you’re not alone!

Lastly, list all those occasional expenses that can pop up and tank the budget. Some might be predictable, like the annual car service or Christmas holiday. Others are less predictable, like replacing white goods or an emergency vet bill. Skim the last 12 months of bank statements and see what jumps out at you.

Once you’ve got a clearer picture, it will be easy to see what you really have left to work with. If your bank balance hits zero before payday, it’s time for Step Two.

Step Two: Get clear on your goals

What are you saving for? Whether it’s the new iPhone or a house deposit, make sure it’s a concrete goal. Once you know what you’re aiming for, you can break the target into manageable chunks. Even if that’s just $50 a fortnight, having it in black and white will help to motivate you.

Consider making a chart or other visual aid to keep you motivated. That might be a picture of the thing you’re saving for, or one of the many ‘savings tracker’ visuals available online. That way, you can literally keep your eyes on the prize.

Knowledge is power, so get comfortable and confront your finances. It’s vital that you know exactly where your money is going.

Step Three: Cut the background costs

When we think budgeting, we often think about sacrificing the guilty pleasures first. However, there are often other savings to be made – and they’re almost painless. Thanks to the exercise in Step One, you know what your regular expenses are. This is a great place to start.

Research whether you can get a better deal on insurance policies and utility bills, and switch providers if you can. Many subscription services will also offer a cheaper rate if you ring up and say you’re thinking of cancelling altogether. If you have any personal loans or existing home loans, you may also be able to get a lower interest rate if you enquire.

By cutting those ongoing costs, you won’t have to give up that Friday night drink with a friend or Monday morning latte after all.

Step Four: Pay yourself first

Does surplus money burn a hole in your pocket? Especially if you’re on a tight budget, it can be all too tempting to spend the extra on something fun. After all, it’s only a little bit of money, right?

To make sure you stay on track, think out of sight, out of mind. By automating your savings, you’ll remove the opportunity to blow the budget.

With the knowledge you’ve gained from the budget exercise, establish what you can afford to sock into savings. Don’t be too restrictive: everyone needs a few treats in their life. Once you’ve settled on a realistic goal, set up a direct debit to move cash from your transaction account to a savings account. For maximum impact, schedule it for payday, and move it into an account that doesn’t have a card attached. The harder it is to access, the better.