What Is A Home Valuation?

by Mark Polatkesen, General Manager - Mortgage Domayne

When you're applying for a bank loan to buy or build your first home, obtaining a property valuation is crucial. This valuation helps the bank determine the value of your property, affecting your loan eligibility and terms. Understanding property valuations early on is essential for making informed financial decisions.

What you should know about a home valuation

A property valuation is an essential part of the home loan application process. It helps your lender calculate your Loan to Value Ratio (LVR). When you apply for a home loan, your potential lender will require a property valuation, often referred to as a bank or professional valuation. This valuation is conducted on your behalf to determine the property's market value.

If you are refinancing an existing home loan, you will also need a bank valuation for both the current and new properties to assess their values. Keeping track of your home's value is crucial for making informed financial decisions regarding loans, insurance, equity, and your overall financial position.

Speaking with licensed finance agents or mortgage brokers is the best way to get a professional valuation underway. They can guide you through the process and ensure that all necessary steps are completed efficiently.

Finance help at Carlisle Homes

At Carlisle Homes, we offer in-house construction finance specialists who provide free, transparent, and no-obligation financial services to save you time and money and get you into your new home faster. Our industry-leading mortgage experts take the time to understand your individual circumstances and help you compare hundreds of home loan options to find the most suitable loan for your needs.

With countless lending options available on the market today for purchasing your new home, finding the right home loan might seem overwhelming. Contact one of our in-house finance experts today.

A formal property valuation is required before you can be granted a loan. The valuer will take into consideration various factors such as location, number of rooms and the condition of your property.

What is a valuation and is it worth it?

A property valuation is a formal report provided by an independent valuer that estimates your property's value. It plays a vital role in buying, selling, refinancing, assessing property taxes, determining insurance coverage, and conducting investment analysis. Banks rely on a panel of independent valuers to provide accurate property valuations.

A formal home valuation is more rigorous than a market appraisal by an estate agent. It considers various factors such as:

- Land Size: The total area of the property.

- Building Size: The overall size of the building, including all levels.

- Number of Rooms: The number of bedrooms, bathrooms, and living areas.

- Location: The property's geographic location and surrounding amenities.

- Condition: The age and condition of the property, including any upgrades or renovations.

- Comparable Sales: The recent sale prices of similar properties in the area.

- Market Conditions: The current state of the real estate market, though valuers do not make future forecasts.

A property valuation is essential for determining your home’s market value, but it’s also important to consider the costs associated with selling. Use our House Selling Cost Calculator to estimate expenses like commissions and legal fees, ensuring you’re fully prepared.

Property valuations are required before you can be granted a loan. The independent valuer will take into consideration various factors such as location, number of rooms and the condition of your property.

Types of property valuations

Different types of home valuations include:

- Market Value: The estimated amount a property would fetch on the open market at a given time.

- Appraisal: A professional opinion of a property's value, often used for setting a sale price or negotiating with buyers.

- Assessment: A value determined by a public official or tax assessor for taxation purposes.

How property valuations impact your financial situation

When a bank lends you money to build or buy a new home, the property itself and its current market value serve as the security for that loan. If you default on your repayments, the bank has the right to sell the property to recover what it is owed. However, if the property is worth less than the amount owed to the bank, the loan won't be repaid in full. Although lenders can pursue the borrower for any shortfall, they understand that a borrower unable to pay their mortgage is unlikely to have available funds elsewhere.

The bank uses the property valuation to calculate your Loan to Value Ratio (LVR). If you’re borrowing more than 80% of the property's value, you will need to take out Lenders' Mortgage Insurance (LMI). A home valuation provides financial clarity and helps in decision-making, ensuring both the borrower and lender have a clear understanding of the property's worth and associated financial risks.

Need help assessing the range of financial products available on the market? Chat with our finance specialists.

How much do property valuations cost in Melbourne?

The cost of property valuations in Australia can vary depending on the property's location and complexity. On average, a property valuation can cost between $300 and $600.

If you’re bank valuation is too low, don’t despair. There are a few options to pursue if this happens such as obtain a second valuation from a different valuer or a family member to be a guarantor if your goal is to avoid LMI.

My house hasn’t been built yet, how will the bank value it?

If you are purchasing a house and land package, the valuer will assess the value of the finished property as if it is already complete. This type of valuation is typically referred to as an On Completion valuation, though some valuers may term it a Tentative On Completion or As If Complete valuation.

It's important to note that this valuation is based on the property's current completion status. The valuer will determine its value in the present market conditions, without considering any potential future changes in the property industry.

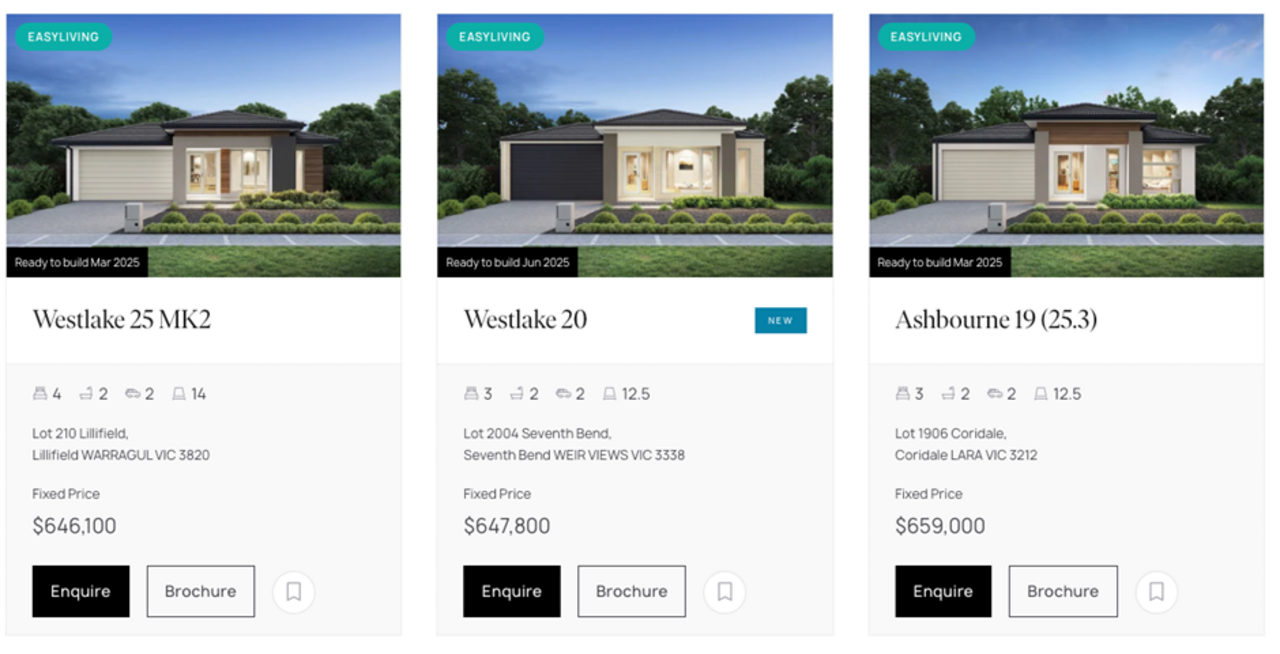

Want to take a look at some house and land packages? We have hundreds of Carlisle Homes packages on our website for you to explore.

The process of conducting a home loan valuation for house and land packages

Conducting a home valuation for building a new home or purchasing a house and land package involves several steps:

- Initial Review: The valuer reviews the proposed building plans and specifications, evaluating the design, materials, and any unique features or planned upgrades. The valuer also inspects the land, assessing its size, shape, and condition.

- Data Collection: The valuer gathers relevant property information, such as land title, zoning details, and planning permissions. They also assess completion date and build timeframes. For official purposes such as tax assessment, this information may also need to be submitted to the State Revenue Office.

- Analysis of Comparable Sales: The valuer examines recent sales of similar properties in the area within a certain date range. This method helps determine the market value by comparing your property to others with similar characteristics.

- Assessment of Conditions: The valuer considers the current market conditions, including supply and demand, economic factors, and trends in the local real estate industry.

- Valuation Report: After completing the inspection and analysis, the valuer compiles a detailed report outlining the estimate of the property's value, including all the factors considered. For a much more informed decision, visit our Home Loan Calculator to explore different financing options for you.

Explore our many available house and land packages on our website.

The importance of accurate property valuations - how to prepare

To ensure an accurate valuation, make sure the valuer takes into account:

- The full list of specifications and inclusions: This includes any land improvements such as landscaping, driveways, or fencing. The quality of fixtures and finishes will impact the final valuation.

- Building Plans: Supply a copy of the building plans, including detailed measurements for living areas, outdoor spaces, bedrooms, bathrooms, and garage spaces.

- Survey Plan: Provide a copy of the survey plan that includes measurements, location, and boundaries of the block of land.

You can still get an On Completion valuation even if your house hasn’t been built yet, but it’s important to understand that the valuation will be done as if the property is complete now. This means it will not take into consideration any projected rise or fall in the property market.

What happens if the bank valuation is too low?

Most of the time, a bank valuation is a standard step in the loan application process, and the valuation comes back at, or close to, the purchase price. However, if the property is unusual, or you buy in a steeply falling market, you may encounter some issues. If the valuation is lower than the purchase price, you might have trouble borrowing the amount you want or the bank might require additional security.

If your bank valuation is too low, don’t despair. There are a few options to pursue if this happens.

Consequences of a Low Bank Valuation

A low bank valuation can significantly impact your mortgage approval and the loan amount you are eligible for. Here are some potential consequences:

- Reduced Loan Amount: The bank may only lend you a percentage of the lower valuation, which means you will need to cover the shortfall yourself.

- Higher LVR: A lower valuation increases your Loan to Value Ratio (LVR), which could result in higher interest rates or the need for Lenders' Mortgage Insurance (LMI).

- Additional Security: The bank might require additional security or collateral to approve the loan.

- Mortgage Approval Delay: A low valuation can delay the mortgage approval process as additional steps may be needed to address the shortfall.

Steps to Take if You Receive a Low Valuation

Receiving a low valuation can be challenging, but there are steps you can take to address the issue:

- Request a Review or Second Opinion: If you believe the valuation is inaccurate, you can request a review or seek a second opinion from another valuer. Ensure you provide all relevant information to support your case.

- Provide Additional Information: Submit any additional information or evidence that might support a higher valuation. This can include recent comparable sales, details of unique property features or inclusion levels.

- Explore Alternative Options:

- Second Valuation: Obtain a second valuation from a different valuer. A new assessment might yield a higher valuation and help you secure the needed loan amount.

- Family Guarantor: If your goal is to avoid Lenders' Mortgage Insurance (LMI), you might consider having a family member act as a guarantor for the loan. This can provide additional security for the lender and help you meet the loan requirements without needing LMI.

- Negotiating with the Bank or Lender: Engage in discussions with your bank or lender based on the valuation. You can present the additional information and dispute why you believe the valuation should be higher. In some cases, lenders may be willing to reconsider the valuation based on new evidence.

- Explore Alternative Financing Options: If the bank is unwilling to adjust the valuation, consider exploring alternative financing options. This might include looking for a lender with more flexible valuation criteria or finding other sources of funding to cover the shortfall.

Navigating a low bank valuation requires patience and proactive steps. By understanding the consequences and knowing how to address a low valuation, you can better manage the process and work towards securing your home loan.

Case study example 1

Michael is buying a new house for $600,000. He has a healthy deposit of $120,000 and is applying for a loan of $480,000. This gives him an LVR of 80% and means he can avoid lenders' mortgage insurance (LMI).

However, the valuation he receives for the house is $560,000. His loan of $480,000 now gives him an LVR of 86%. To proceed, he will need to either increase his deposit or take out LMI, which will be calculated on the new LVR.

This situation can be a real stumbling block for borrowers who only have the minimum 5% deposit available. If the valuation falls short of the purchase price, their deposit might not be sufficient, leading to additional financial challenges.

Case study example 2

Catherine is buying a new house for $600,000, but her deposit is only $60,000. She is applying for a loan of $540,000, giving her an LVR of 90%, which includes taking out LMI.

Her valuation comes back at $560,000. Her new LVR is 96.4%, which is too high under her lender’s rules. Unless she can increase her deposit by at least $10,000 (bringing her loan down to $530,000 and her LVR to 94.6%), she won’t be able to borrow the money she needs.

If you find yourself in a similar situation, it’s important to understand there are a few avenues to pursue, including:

- Ask the bank to obtain a second valuation from a different valuer. Each valuer has a different set of criteria and algorithms, so you might get a different result.

- Explore whether you can increase your deposit to meet the lender’s requirements.

- Consider having a family member act as a guarantor if your goal is to avoid LMI.

Working with a licensed financial advisor that specialises in construction home loans can help you through situations such as these ones. They can assist you in ways you can meet lenders’

criteria and secure the necessary funds for your home purchase. Refer to our finance page for more information.

Home Files Podcast by Carlisle

Did you know we have a podcast that covers everything you need to know about purchasing a new home? We have two two episodes specifically related to finance where we chat with expert mortgage brokers to discuss how you assess applicable costs when building a new home, determine your borrowing capacity and establish your financial position and budget.

Refer to our two episodes for finance help:

- Season 1, Episode 3 - Making Home Finance Sexy (Knockdown rebuild focus)

- Season 2, Episode 2 - Affordable Abode: Budgets and Finances (First home buyer focus)

Listen at your convenience - available wherever you get your podcasts.

The importance of property valuations in your home buying journey

To summarise all that we’ve discussed, a property valuation:

- Provides an indication of what your property is worth.

- Is arranged by your lender when applying for a home loan or refinancing.

- Can be used for legal matters if conducted by a certified professional.

-

Is helpful when selling your property or making a will.

Understanding and obtaining a home valuation is crucial for making informed financial decisions. It not only impacts your loan approval and terms but also helps you manage your property's equity and plan for the future. Property valuations are also essential for complying with state regulations and tax assessments, such as those required by the State Revenue Office. Keeping an accurate valuation can ensure that you are correctly assessed for land tax and other state-imposed fees.

For those planning to build their dream home, we encourage you to work with Carlisle Homes for comprehensive financial services and expert guidance throughout your home-building journey. Contact us today to learn more about how we can support you in making your dream home a reality.

Want to learn more? Check out the Financial Services section of our website or speak to one of our friendly loan specialists on 1300 328 045. Find more information in the finance section of Home Files here.

Mark Polatkesen

General Manager - Mortgage Domayne

With over two decades of experience in the finance industry, Mark Polatkesen leads Mortgage Domayne, one of Australia’s largest construction-focused mortgage brokerages.

Learn more about Mark Polatkesen